Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• Russia expected to restart Nordstream I Natural Gas pipe on Thursday, with 40% capacity.

• Eurozone June CPI up 8.6%, last 8.6%, est. 8.6%.

Iron Ore Key Indicators:

• Platts62 $96.45, -4.45, MTD $107.61. Resurgence of Covid-19 spread in new areas of China, plus the unexpected high temperature hit China after an extreme rainy weather, and the steel mills joint production cut, cracked down the purchase on raw materials. Steel production is expected to go lower until the resolution of oversupply. Physical traders were trying to clear cargoes on hand.

• BHP FY Q4 production at 71.66 million tons, down 1.6% on the year, up 7.4% compared to Q3.

• Rio Tinto Q2 Pilbara iron ore production at 78.6 million tons, up 4% on the year. Guided delivery at 79.9 million tons, up 5% on the year. Annual delivery target unchanged at 320 -335 million tons.

• Vale iron ore production 74.11 million tons, up 17.4% from last quarter, down 1.2% on the year. Vale decrease annual production target from 320 -325 million tons to 310 – 320 million tons.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 19th)

• Futures 103,907,500 tons(Increase 6,104,800 tons)

• Options 88,383,000 tons(Increase 4,520,000 tons)

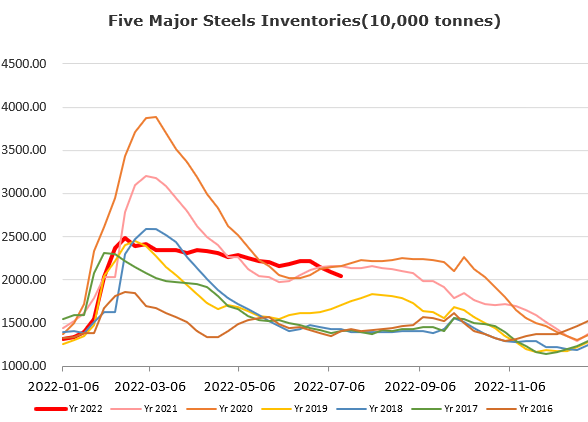

Steel Key Indicators

• China Shanxi province saw four new increased blast furnace maintenance. One of the mills cur utilisation by 25% because of the continuous marginal loss on production.

Coal Indicators

• Chinese top 10 coal makers total produced 1.13 billion tons of coals in H1 2022, up 90 million tons w-o-w. Top ten coal producers accounted for 51.6% of total coal capacity above designated scale.

• Hebei province started the fourth round of decrease on the coke purchase price by 200 yuan/ton, total down 800 yuan/ton during last four rounds.