Market Verdict on Iron Ore:

• Neutral.

Macro

• China July 1-year LPR at 3.7%, est. 3.7%, last 3.7%. 5-year LPR 4.45%, est. 4.45%, last 4.45%.

• The European Central Bank is expected to raise interest rates for the first time in 11 years on July 21st. Market expect the interest hike would raise from 25 bp previously to 50 bp.

Iron Ore Key Indicators:

• Platts62 $97.55, +1.10, MTD $106.83. Resurgence of Covid-19 spread in new areas of China, plus the unexpected high temperature hit China after an extreme rainy weather, and the steel mills joint production cut, cracked down the purchase on raw materials. Steel production is expected to go lower until the resolution of oversupply. Physical traders were trying to clear cargoes on hand.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 20th)

• Futures 108,198,000 tons(Increase 4,290,500 tons)

• Options 91,128,000 tons(Increase 2,745,000 tons)

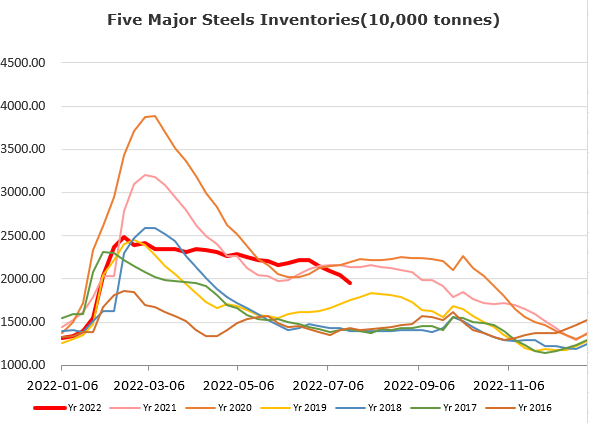

Steel Key Indicators

• China Shanxi province saw four new increased blast furnace maintenance. One of the mills cur utilisation by 25% because of the continuous marginal loss on production.

Coal Indicators

• Hebei province started the fourth round of decrease on the coke purchase price by 200 yuan/ton, total down 800 yuan/ton during last four rounds.

• China H1 2022 total coal production 2.19 billion tons, up 11% y-o-y.