Market Verdict on Iron Ore:

• Neutral.

Macro

• China NBS June excavators produced 21,769 units, down 3.4% on the year(May down 30.4%). H1 produced 156,803 units, down 27.1% on the year.

• European central bank decided to increase 0% interest rate by 50 bp, created the first interest rate hike in the past 11 years. Market expected a 25bps hike previously.

• U.K. started new round of sanction against Russian coal and oil, effective on August and December respectively.

Iron Ore Key Indicators:

• Platts62 $96.40, -1.15, MTD $106.09. Resurgence of Covid-19 spread in new areas of China, plus the unexpected high temperature hit China after an extreme rainy weather, and the steel mills joint production cut, cracked down the purchase on raw materials. Steel production is expected to go lower until the resolution of oversupply. Physical traders were trying to clear cargoes on hand.

• MySteel 45 ports iron ore inventories at 131.95 million tons, up 1.66 million tons w-o-w. Daily evacuation 2.61 million tons, down 135,800 tons w-o-w. Australia iron ore 61.62 million tons, up 593,700 tons w-o-w. Brazil iron ore 44.23 million tons, up 1.53 million tons w-o-w. 85 ships at ports, down 23.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 21st)

• Futures 110,019,200 tons(Increase 1,821,200 tons)

• Options 93,038,000 tons(Increase 1,910,000 tons)

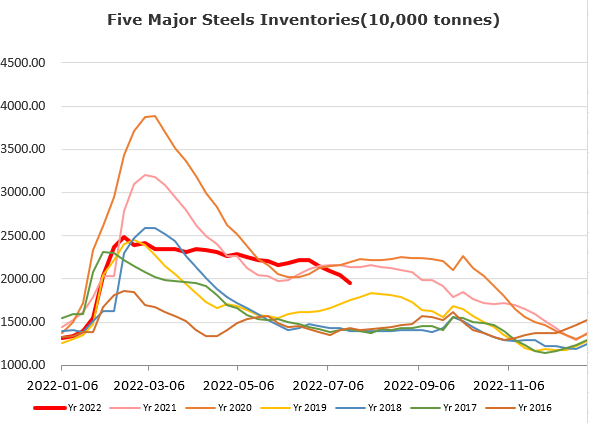

Steel Key Indicators

• China June crude steel production 90.73 million tons, down 3.3% on the year. H1 2022 crude steel production 526.88 million tons, down 6.5% year-on -year.

Coal Indicators

• China H1 2022 total coal production 2.19 billion tons, up 11% y-o-y.