Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• Russia and Ukraine signed agreements with Turkey and the United Nations on the transportation of agricultural products from the Black Sea ports, and the parties will cooperate to export grain from three Ukrainian ports, including Odessa.

• According to the sanctions adjustment agreed by EU Member States, Russian oil and gas will be able to deliver crude oil to the third party countries, which aims to mitigate the risk of global energy security.

Iron Ore Key Indicators:

• Platts62 $100.35, +3.95, MTD $105.71. The term contract discounts for BHP’s August MACF widened to 4.8% from 4%, JMBF to 9.3% from 9.25%. Steel margins improved after the decrease in coke and iron ore prices during past few weeks. Construction steel daily trades increased from last week significantly. Multiple buying interests on MOC were heard for PBF, NHGF, after bids vanished for almost four weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 22th)

• Futures 113,530,500 tons(Increase 3,511,300 tons)

• Options 96,717,000 tons(Increase 3,679,000 tons)

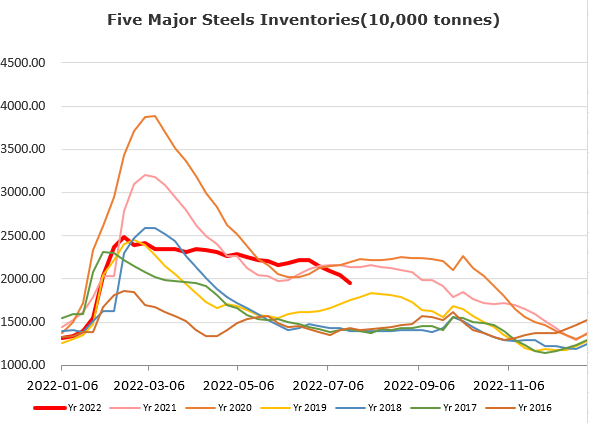

Steel Key Indicators

• China 247 sample steel mills blast furnace utilisation rate at 73.16%, down 3.81% w-o-w, down 9.62% on the year.

• World Steel Association reported crude steel production 158.1 million tons, down 5.9% on the year.

Coal Indicators

• China H1 2022 total coal production 2.19 billion tons, up 11% y-o-y.