Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• ECB official Kazaks indicated that the big interest hike expected to continue.

• China Industry of Steel Association and India Steel Association held video conference to communicate the future corporation in iron ore and coals.

• China Evergrande group, the house developer with the biggest debt trouble in the world, is expected to announce a restructuring plan this week, indicated that the Chinese government plans to deal with the crisis in the real estate industry.

Iron Ore Key Indicators:

• Platts62 $104.00, +3.65, MTD $105.60. The term contract discounts for BHP’s August MACF widened to 4.8% from 4%, JMBF to 9.3% from 9.25%. Steel margins improved after the decrease in coke and iron ore prices during past few weeks. Construction steel daily trades increased from last week significantly. Multiple buying interests on MOC were heard for PBF, NHGF, after bids vanished for almost four weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 25th)

• Futures 114,652,300 tons(Increase 1,121,800 tons)

• Options 97,422,500 tons(Increase 705,500 tons)

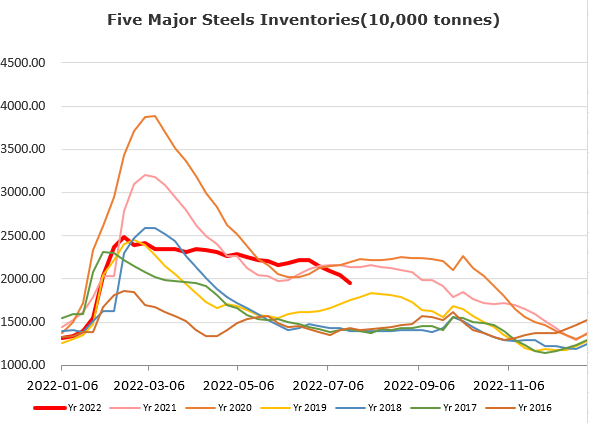

Steel Key Indicators

• World Steel Association reported crude steel production 158.1 million tons, down 5.9% on the year.

Coal Indicators

• China H1 2022 total coal production 2.19 billion tons, up 11% y-o-y.