Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• IMF decreased global GDP growth in 2022 from 3.6% to 3.2%.

• U.S. white house indicated that the country would release 20 million barrels of crude oil supply from its national reserve, 1 million barrels on daily basis.

• Chinese Machinery Association statistic said that the total machinery sales 20,761 units, down 10.1% on the year, created a consecutive 14-month drop.

Iron Ore Key Indicators:

• Platts62 $111.70, +7.70, MTD $105.96. The term contract discounts for BHP’s August MACF widened to 4.8% from 4%, JMBF to 9.3% from 9.25%. Steel margins improved after the decrease in coke and iron ore prices during past few weeks. Construction steel daily trades increased from last week significantly. Multiple buying interests on MOC were heard for PBF, NHGF, after bids vanished for almost four weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 26th)

• Futures 116,172,000 tons(Increase 1,519,700 tons)

• Options 97,777,500 tons(Increase 355,000 tons)

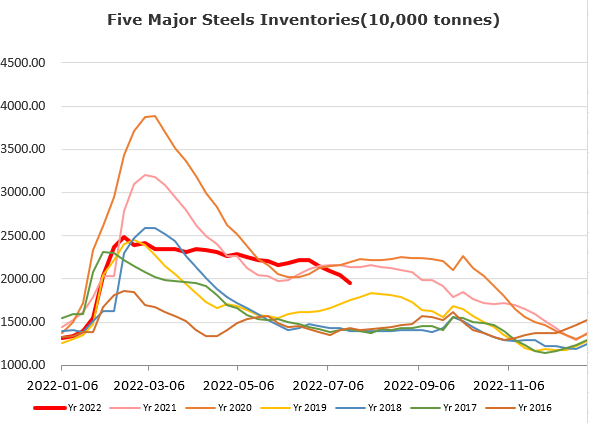

Steel Key Indicators

• World Steel Association reported crude steel production 158.1 million tons, down 5.9% on the year.

Coal Indicators

• Australia PLV massively corrected as the JSW Steel confirmed a previous trade at $195 for Goonyella C and Caval Ridge in an August laycan.

• China’s coke market has yet to see a formal proposal for the fifth round of price cuts. Some Chinese mills were expecting a recovery on production in next month.