Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• China and U.S. held tele-conference to discuss on the cooperation in economy development in future, and noted the tariff exemption to alleviate the inflation in U.S.

Iron Ore Key Indicators:

• Platts62 $117.95, +6.90, MTD $106.86. The term contract discounts for BHP’s August MACF widened to 4.8% from 4%, JMBF to 9.3% from 9.25%. Steel margins improved after the decrease in coke and iron ore prices during past few weeks. Construction steel daily trades increased from last week significantly. Multiple buying interests on MOC were heard for PBF, NHGF, after bids vanished for almost four weeks.

• MySteel 45 ports iron ore inventories at 135.35 million tons, up 3.4 million tons w-o-w. Daily evacuation 2.5984 million tons, down 8,700 tons w-o-w. Australia iron ore 62.08 million tons, up 456,000 tons w-o-w. Brazil iron ore 45.2 million tons, up 973,200 tons w-o-w. 69 ships at ports, down 16.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 28th)

• Futures 119,673,700 tons(Increase 2,729,900 tons)

• Options 99,911,500 tons(Increase 1,494,000 tons)

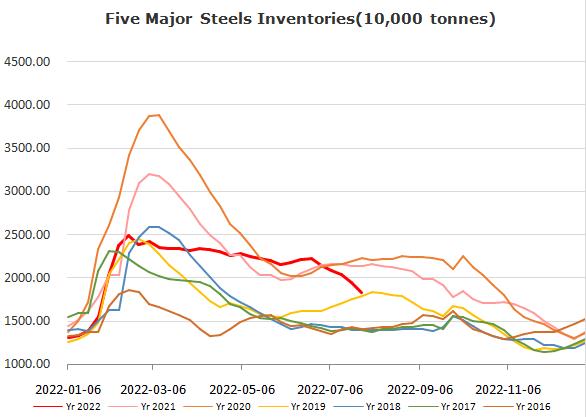

Steel Key Indicators

• Chinese 40 independent EAFs average billet cost 3895 yuan/ton, up 100 yuan/ton on the week. Average profit 113 yuan/ton, down 84 yuan/ton w-o-w.

• 247 steel mills daily pig iron production 2.1358 million tons, down 56,600 tons on the week. Blast furnace operation rate 71.61%, down 15,500 on the week.

Coal Indicators

• Some Chinese steel mills started to decrease bids on coke by 200 yuan/ton, five rounds total decrease by 1000 yuan/ton.