Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• China PM Li Keqiang held conference after the political conference held last week to promote investment and consumption, including acceleration on local debts, investment projects in the central budget, automobile consumption, green energy home appliances and green building materials.

• China July PMI 49%, lower than boom and bust line. However building activity index 59.2%, 2.6% higher than previous month.

• China Evergrande revealed debt restructure progress, expecting details of the plan in next few months.

Iron Ore Key Indicators:

• Platts62 $114.00, -3.95, MTD $107.22. The term contract discounts for FMG in August widened in August, however market participants indicated that the current discounts were not great enough to attract buying interest. Mainstream seaborne cargoes including PBF, MACF, NMHG and JMBF were traded actively during the past two weeks. However the secondary market maintained quiet, indicating the demand market was yet to catch up with the fast increasing price on primary market.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 29th)

• Futures 88,992,800 tons(Decrease 30,680,900 tons)

• Options 82,208,500 tons(Decrease 17,703,000 tons)

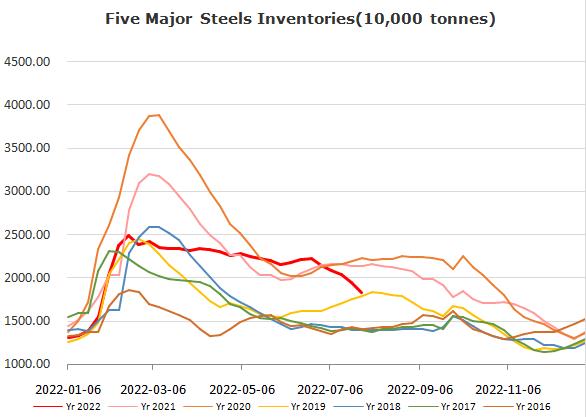

Steel Key Indicators

• TS billet up 130 yuan at 3760 yuan over weekends, created the biggest increase during weekends from June.

Coal Indicators

• No seaborne was traded late last week, a bid was heard at $168/mt FOB Australia for 75,000mt of GlobalCoal HCCLV Peak Downs down from $180 significantly placed previously. Southeast Asian end-user placed bids around $165- 175/mt.