Market Verdict on Iron Ore:

• Neutral.

Macro

• U.S. New York Federal survey indicated that the future three-year inflation expectation fell from 3.6% to 3.2%.

Iron Ore Key Indicators:

• Platts62 $108.80, +1.85, MTD $108.98. The term contract discounts for FMG in August widened in August, however market participants indicated that the current discounts were not great enough to attract buying interest. Mainstream seaborne cargoes including PBF, MACF, NMHG and JMBF were traded actively during the past two weeks. However the secondary market maintained quiet, indicating the demand market was yet to catch up with the fast increasing price on primary market.

• Aug 1- 7th MySteel 19 ports iron ore deliveries at 26.11 million tons, down 421,000 tonnes on the week. Australia deliveries at 19.06 million tons, up 1.55 million tons on the week. Brazil deliveries 7.06 million tons, down 1.97 million tons on the week. Global iron ore deliveries at 31.22 million tons, down 11.18 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 5th)

• Futures 93,147,000 tons(Increase 1,032,500 tons)

• Options 87,160,000 tons(Increase 25,000 tons)

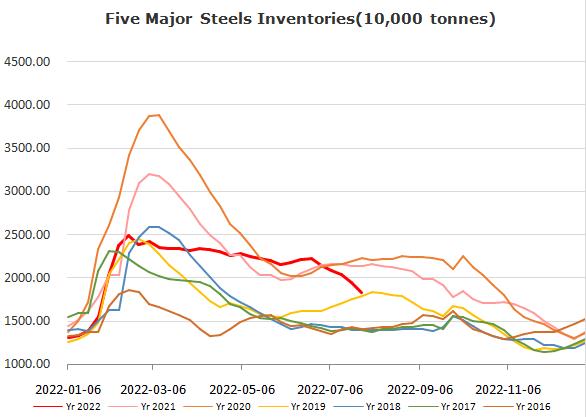

Steel Key Indicators

• China Jan- Jul exported 40.07 million tons of steels, down 6.9% on the year.

Coal Indicators

• FOB Australia market saw a bid up $1 to $201 for 75,000mt GlobalCoal HCCA Branded with September laycan.