Market Verdict on Iron Ore:

• Neutral.

Macro

• U.S. July CPI up 8.5%, last 9.1%, est. 8.7%. China July CPI up 2.7 on the year, last 2.5%, est. 2.9%.

• Chinese machinery sales in July turned from negative to positive, ended a negative number last for previous 14 months. Jan – Jul machinery sales 161,033 units, down 33.2% on the year.

Iron Ore Key Indicators:

• Platts62 $108.40, -0.40, MTD $108.89. The current market interests were centered around mid-grade including PBF and NMF, because of the cost-efficiency and production recovery in China. In addition, the demand raw materials recovered significantly in southeastern mills. The term contract discounts for FMG and BHP in August widened. However be aware of PBF was slight oversupplied in seaborne market, which might limit the room of growth in the near future.

• MySteel 45 ports iron ore inventories at 138.86 million tons, up 1.82 million tons w-o-w. Daily evacuation 2.73 million tons, up 48,100 tons w-o-w. Australia iron ore 64.43 million tons, down 100,600 tons w-o-w. Brazil iron ore 46.1 million tons, up 1.227 million tons w-o-w. 81 ships at ports, up 7.

SGX Iron Ore 62% Futures& Options Open Interest (Aug11th)

• Futures 94,915,400 tons(Increase 1,043,200 tons)

• Options 90,406,000 tons(Increase 770,500 tons)

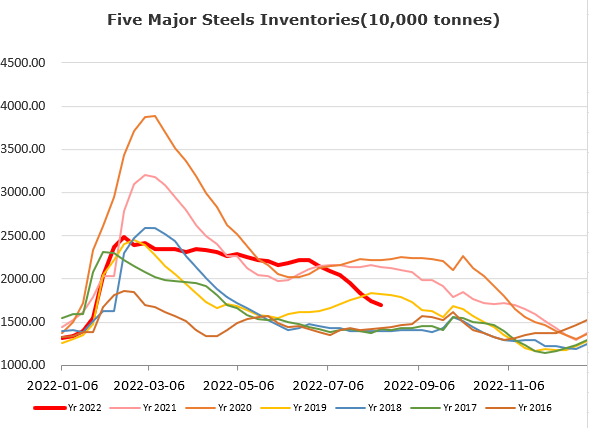

Steel Key Indicators

• MySteel 247 blast furnace operation rate at 76.24%, up 3.54% on the week, down 6.34% on the year. Daily pig iron production at 2.1867 million tons, up 43,600 tons on the week, down 116,600 on the year.

Coal Indicators

• The first round of physical coke price rise by 200- 240 yuan will be fully implemented during Aug 9-10th.

• MySteel 16 Chinese ports coking coal inventory 5.857 million tons up 25,000 tons on the week.