Market Verdict on Iron Ore:

• Neutral.

Macro

• Chinese Loan Prime Rate at 1-year length cut 5 bps to 3.65%, 5-year length at 4.3%, cut 15 bps.

• Chinese State Council decided to extend the policy of exempting new energy vehicles from purchase tax to the end of next year, and it is estimated that the new tax exemption will cover 100 billion yuan to support EV industries. In addition, the State council also promote the building of charging stations.

• Many Chinese cities have to start power staggering because of the hot weather boosted the power usage beyond maximum load. At the same time, some steek-makers and downstream have to temporarily stop operation and start high temperature holiday. However, it is expected the power consumption would fall as cool weather start in late August and early September.

Iron Ore Key Indicators:

• Platts62 $99.70, -0.90, MTD $106.49. Both seaborne and portside market saw a cooling down on buying interest during the week. PBF inventories at Shandong reached 5 million tons, which were 5 times bigger than normal inventories level in previous few years. Thus, PBF sellers expected to complete the deal before landing on ports. The trades potentially shift from sellers’ option to buyers side. On the discount market, MACF regained buying interest and traded in both fixed and float price. The fixed price traded in range $94-98, and float trade has a $10.3-10.8 discount based on September Index.

• The front month spreads expected to have some more room to grow, in particular Sep-Oct, or Oct-Nov, due to the acceleration on Chinese mills production recovery, which would bring back some prompt demands to this market.

• West Australia government approved Wonmunna iron ore production to 13.5 mtpa from 10 mtpa.

SGX Iron Ore 62% Futures& Options Open Interest (Aug19th)

• Futures 97,892,000 tons(Increase 1,076,200 tons)

• Options 95,997,500 tons(Increase 1,285,000 tons)

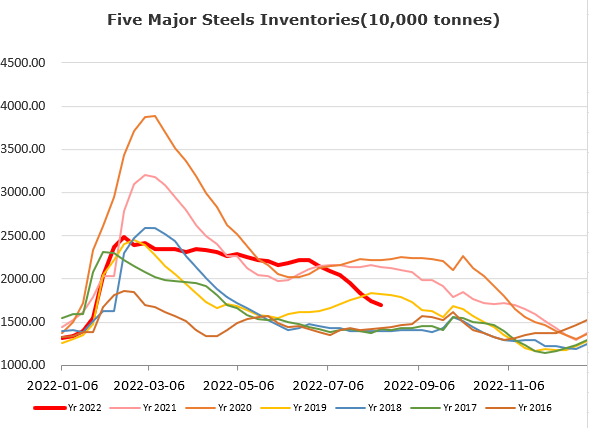

Steel Key Indicators

• Eastern Chinese Mills increased purchase price of scrap by 700 yuan in July for several rounds, recovered most of losses in June.

Coal Indicators

• Australia met coal saw mixed outlook during last week, since buyers were waiting for new direction. Current buyers put bids at similar level with no improvements. A 75,000 mt PMV FOB Australia cargo was offered at $265. The tradeable level for Goonyella and Goonyella C PMV ranged from $245 – 275 from market participants. Chinese end-users indicated that traders prefer to buy portside instead of seaborne as port stocks upticks since last two months.