Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• China NBS: July excavators produced 19,612 units, down 3.2% on the year. Jan-July total produced 185,743 units, down 25.6% on the year. Jan- July total sold 161,033 units, down 33.2% on the year.

• World Steel Association statistic indicated that 64 member countries total produced 149.3 million tons of crude steel, down 6.5% on the year.

• MySteel 170 power plants total coal inventories 26.17 million tons, down 267,000 tons w-o-w. Daily consumption 1.575 million tons, up 28,000 tons w-o-w. Inventory turnover at 17 days.

Iron Ore Key Indicators:

• Platts62 $102.30, +1.65, MTD $105.86. Both seaborne and portside market saw a cooling down on buying interest during the week. PBF inventories at Shandong reached 5 million tons, which were 5 times bigger than normal inventories level in previous few years. Thus, PBF sellers expected to complete the deal before landing on ports. The trades potentially shift from sellers’ option to buyers side. On the discount market, MACF regained buying interest and traded in both fixed and float price. The fixed price traded in range $94-98, and float trade has a $10.3-10.8 discount based on September Index.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 23rd)

• Futures 99,375,800 tons(Increase 716,400 tons)

• Options 98,102,000 tons(Increase 1,291,000 tons)

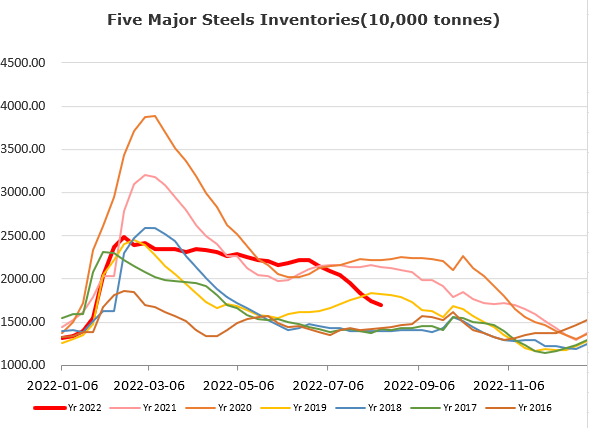

Steel Key Indicators

• CISA indicated that steel consumption would catch up as the recovery of economy.

Coal Indicators

• Australia met coal saw mixed outlook during the week, since buyers were waiting for new direction. Current buyers put bids at similar level with no improvements. A 75,000mt PMV FOB Australia cargo was offered at $268 Caval Ridge for almost a week. The tradeable level for PMV ranged from $245 – 275 from market participants. Chinese market was waiting for the third round of physical coke rise.