Market Verdict on Iron Ore:

• Neutral.

Macro

• An official from the Ministry of Industry and Information Technology (MIIT) said at the raw material industry high-quality development press conference that the prices of steel, copper, aluminum, cement and other products have declined recently, and that the MIIT will continue to ensure supply and stabilise prices in the next step, the CCTV News reported. The MIIT will promote stable production and supply in key industries. In addition, the MIIT will also establish a linkage monitoring mechanism for key raw material prices to guide the price stabilisation of key products such as lithium carbonate and rare earth.

• Qualified foreign institutional investors and RMB qualified foreign institutional investors are now allowed to trade some commodity futures and option contracts at China’s commodity exchanges. At Shanghai International Energy Exchange, those investors can trade crude oil futures and option contracts, as well as futures contracts of low sulfur fuel oil, among other. At Dalian Commodity Exchange, such investors can participate in trading of futures and option contracts of soybean, palm oil and iron ore, among others. At Zhengzhou Commodity Exchange, those investors can now trade futures and option contracts of sugar and rapeseed oil, among others

Iron Ore Key Indicators:

• Platts62 $95.6, -5.35, AVG $95.6. The structure curve was still believed at narrow area since the medium over last 12 months was $0.57 for the next months and the following month contract, i.e. Oct22-Nov22. However the spread currently was in $0.4-0.45. PBF and NMHG regained popularity, with significantly improved volume in late half of August and discount/premium. Chinese northern ports has over 6 million tons of pellets, which hasn’t no change since June. However India mills were anxious about their pellets inventories on hand. The premium was hitting three-year-low, given the high export tax.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 2nd)

• Futures 90,211,500 tons(Increase 570,100 tons)

• Options 81,590,100 tons(Increase 1,370,000 tons)

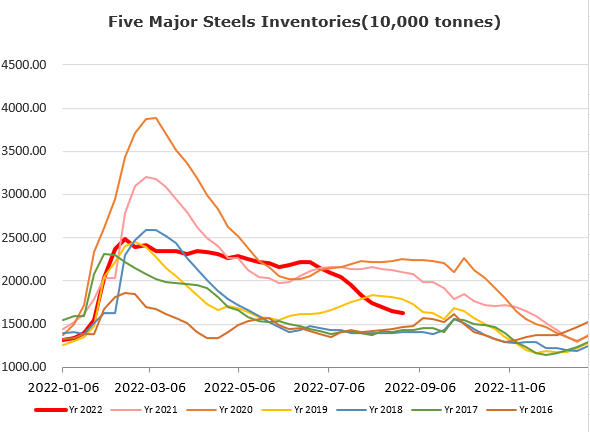

Steel Key Indicators

• Mysteel sample steel mills iron ore inventories at 97.4 million tons, down 1.27 million tons on the weeks. Daily import iron ore consumption at 2.83 million tons, up 51,000 tons on the week.

• MySteel researched 85 independent EAFs, with operation rate at 56.74%, up 2.92% on the week. Average utilisation rate at 45.83%, up 6.41% on the week.

Coal Indicators

• Chinese 247 steel mills coke average production 472,100 tons. Coke inventories 6.14 million tons, up 241,000. Steel mills have 11.71 useable days on coke, up 0.5 days on the week. Coking coal inventories 8.10 million tons, down 39,000 tons on the week. Steel mills have 12.89 useable days on coking coal.

• Australia PLV market was quiet over the previous two weeks. There was a 75,000mt GlobalCoal offer with Oct 1- 10th laycan, however not met with buying interest.