Market Verdict on Iron Ore:

Neutral to bullish.

Macro:

The Muifa Typhoon entered inland China, while Chinese eastern ports area recovered normal operation after stopped for two days because of Typhoon and heavy rains.

U.S. August PPI up 8.7%, est. 8.8%, last 9.8%. U.S. five-year T-bond yield refreshed highest since 2008 at 3.62%.

Chinese PM Li Keqiang held Conference emphasised on increasing loans and debts to renew facilities of industries and explore market demand, stablising export and economy growth. Support banks to provide medium and long-term loans at an interest rate at 3.2% or lower to manufacturers, social services and mid-small capitals in Q4 . The PBOC granted special refinancing amount at 100% of the loan principal. The refinancing amount totaled 200 billion yuan, with a term of one year and two extensions. We will implement the policy of 2.5% discount interest from the central government, and the actual loan cost of loan holders who will upgrade and renovate equipments in the fourth quarter of this year will not be higher than 0.7%.

Iron Ore Key Indicators:

Platts62 $100.80. -3.45, MTD $99.33. The structure curve of Oct-Nov22 recovered from low area at $0.35 to $0.55, which was a mid-level area because the medium of spread of second and third month was $0.57 tracing back last 12 months. PBF and NMHG regained popularity, with significantly improved volume in late half of August and discount/premium.

Pellet premiums grew in Asian market as recovered demand. However market participants suspectected the consistancy of the pellet prices, with obviously oversupply from India market. In addition, European countries started several rounds of steel production cuts from September.

China Baowu Group signed agreement with Rio Tinto to develop the west Pilbara projects and set up joint venture. The project target to produce 275 million tons iron ores with 25 MTPA and averaged 62% on the iron ore grade, with total investment of 2 billion U.S. dollars.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 14th)

Futures 101,605,600 tons(Increase 203,600 tons)

Options 89,796,100 tons(Increase 110,000 tons)

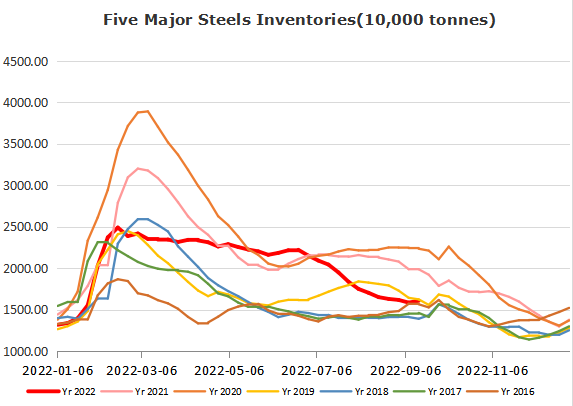

Steel Key Indicators

POSCO announced to recover operation from 10th for its No. 3 blast furnace. No.2 and No.4 blast furnace would resume from September 12th respectively. POSCO previously suffered from fire accident and typhoon landing.

Coal Indicators

Australia FOB coking coal maintained at $271.0-273.25 for almost three weeks – market was waiting for clearer direction. There was 75,000mt HCCLV Peak Downs offer at $275, with cut-off time for bids from 4-7p.m. this afternoon. There were $330-335 offers from U.S. Blue Creek No.7 and Oak Grove coking coal on the market during current two weeks, however no bid was close to the level.