Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• Super Central Bank week: Ten countires including U.S. Federal would finalise the interest rate decision during this week.

• U.S. Shale oil and gas companies announced European buyers that they can’t provide additional energies in this winter. Once Europe ban on Russia oil taking into effect, oil supply expected to become extreme tight again.

Iron Ore Key Indicators:

• Platts62 $101.05, +0.25, MTD $99.48. Market saw several CSN cargoes traded including IOC6. 6.5-9% silicon differential fell by 35% to $4, market expect the differential could see some support, with the upcoming Golden week and National congress in China, which would cause 3-4 week length maintenance in downstream or mills. The structure curve of Oct-Nov22 recovered from low area at $0.35 to $0.55, which was a mid-level area because the medium of spread of second and third month was $0.57 tracing back last 12 months. PBF and NMHG regained popularity, with significantly improved volume in late half of August and discount/premium, however market participants believed that the current level was close to roof area as there were not enough room on the steel margin left. Thus, low grade and discount iron ores including JMBF regained market interest with narrowing discounts.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 16th)

• Futures 101,980,000 tons(Increase 404,500 tons)

• Options 90,949,100 tons(Increase 755,500 tons)

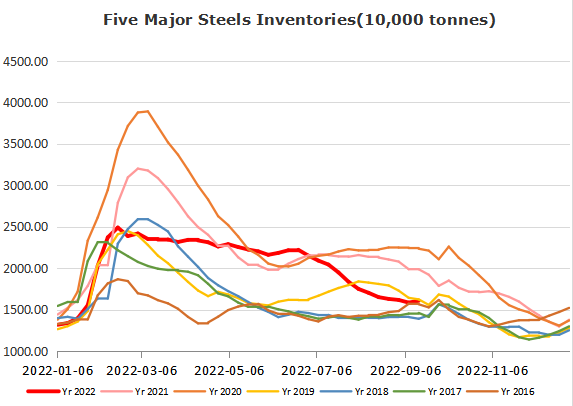

Steel Key Indicators

• Arcelor Mittal announced to close the No. 3 blast furnace in Poland, the rest two maintain normal operation. Arcelor Mittal has closed blast furnaces in France, Germany, Austria in September.

• Integrated steelmaker US Steel has idled its No. 8 blast furnace at its Gary Works steel mill in Indiana, which has a raw steel capacity of 1.5mn short tons (st)/yr, was idled on 7 September, the company said. It did not disclose a restart date.

Coal Indicators

• Australia FOB coking coal maintained at $271.0-273.25 for almost three weeks, however corrected $20 to $250.5 yesterday because the last two trade with 25,000 and 34,000 booked by Asian mills were both at $252.0, however market expect slight room of correction as many buyers emerged at $248- 250 levels. China CFR coking coal market was resilient at $290-295, supported by the domestic coal price.