Market Verdict on Iron Ore:

• Neutral to bullish.

Macro

• China NDRC would accelerate financial investment tools total amount 300 billion yuan to help infrastructure projects landing.

• Moody decreased global GDP to 2.4% from 2.9% in June, dragged by the energy crisis in Europe, inflation and tightened monetary policies in global countries. Moody expected that Eurozone would enter recession from late Q3, U.S. would enter mild recession from mid-2023.

Iron Ore Key Indicators:

• Platts62 $97.70. -0.75 . MTD $99.27. Market saw several CSN cargoes traded including IOC6. 6.5-9% silicon differential fell by 35% to $4, market expect the differential could see some support, with the upcoming Golden week and National congress in China, which would cause 3-4 week length maintenance in downstream or mills. The structure curve of Oct-Nov22 maintianed in the range from $0.45 to $0.55, close to the medium of $0.57 tracing the previous 12 months. PBF and NMHG regained popularity, with significantly improved volume in late half of August and discount/premium, however market participants believed that the current level was close to roof area as there were not enough room on the steel margin left. Thus, low grade and discount iron ores including JMBF regained market interest with narrowing discounts.

• Australia and Brazil total delivered 25.42 million tons of iron ore, up 1.677 million tons on the week. Australia delivered 18.69 million tons, up 1.27 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 19th)

• Futures 102,934,600 tons(Increase 954,600 tons)

• Options 91,139,100 tons(Increase 190,000 tons)

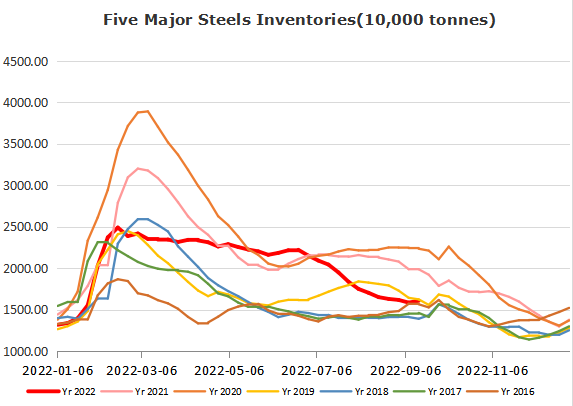

Steel Key Indicators

• CISA statistic indicated that total produced 66.03 million tons of crude steels, down 2.15% from July. Daily production 2.13 million tons, up 1.42% on the month.

Coal Indicators

• Australia FOB coking coal maintained at $271.0-273.25 for almost three weeks, however corrected $20 to $250.5 yesterday because the last two trade with 25,000 and 34,000 booked by Asian mills were both at $252.0, however market expect slight room of correction as many buyers emerged at $248- 250 levels. China CFR coking coal market was resilient at $290-295, supported by the domestic coal price.