Market Verdict on Iron Ore:

Neutral.

Macro

European Central Bank President Lagarde is expected to further increase interest rates. ECB indicated that the inflation prospect will determine the terminal point of interest rate.

Canada August CPI up 7% on the year, lower than 7.6% in July, lower than estimated 7.3%. Japan core CPI up 2.8%, created continuous 12-month increase, refreshed the highest since October 2014.

Iron Ore Key Indicators:

Platts62 $97.70. -0.75 . MTD $99.27. Market saw several CSN cargoes traded including IOC6. 6.5-9% silicon differential fell by 35% to $4, market expect the differential could see some support, with the upcoming Golden week and National congress in China, which would cause 3-4 week length maintenance in downstream or mills. The structure curve of Oct-Nov22 maintianed in the range from $0.45 to $0.55, close to the medium of $0.45 tracing the previous 12 months. PBF and NMHG regained popularity, with significantly improved volume in late half of August and discount/premium, however market participants believed that the current level was close to roof area as there were not enough room on the steel margin left. Thus, low grade and discount iron ores including JMBF regained market interest with narrowing discounts. ITG sold 150,000mt PBF to Majestic Rock Resources Group during MOC at October Index + $0.45. CSN sold multiple laycans of IOC6, currently market saw improving interest in high silica products.

Australia and Brazil total delivered 25.42 million tons of iron ore, up 1.677 million tons on the week. Australia delivered 18.69 million tons, up 1.27 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 20th)

Futures 103,655,700 tons(Increase 721,100 tons)

Options 91,259,100 tons(Increase 120,000 tons)

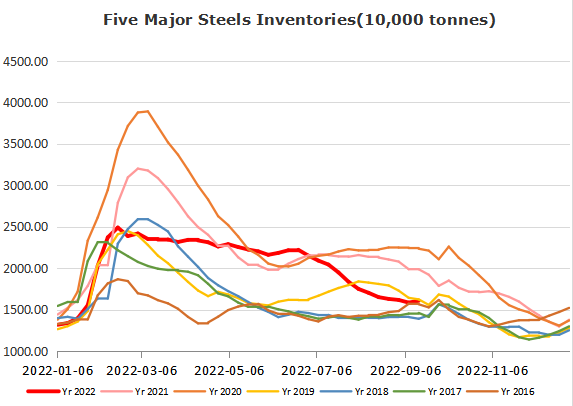

Steel Key Indicators

CISA statistic indicated that total produced 66.03 million tons of crude steels, down 2.15% from July. Daily production 2.13 million tons, up 1.42% on the month.

Coal Indicators

Australia FOB coking coal up $6 yesterday to $256.5, leaving the $250 range, with a 75,000mt Goonyella PMV traded at $255.