Market Verdict on Iron Ore:

Neutral to bullish.

Macro:

U.S. Federal increased 75 bps in September FOMC to 3.00-3.25%. Powell quoted the interest plot matrix that the Federal potentially increase 100-125 bps for the remaining of 2022.

The Asian Development Bank released a report of Asian Development Outlook 2022, and lowered the economic growth forecast of developing Asian economies to 4.3% this year, compared with 5.2% previously.Economic growth forecast for 2023 was also lowered to 4.9% from 5.3%. The ADB lowered China’s economic growth forecast this year to 3.3%.

Iron Ore Key Indicators:

Platts62 $96.40. -0.25 . MTD $98.9. Market saw several CSN cargoes traded including IOC6. 6.5-9% silicon differential fell by 35% to $4, market expect the differential could see some support, with the upcoming Golden week and National congress in China, which would cause 3-4 week length maintenance in downstream or mills. The structure curve of Oct-Nov22 maintianed in the range from $0.45 to $0.55, close to the medium of $0.45 tracing the previous 12 months. PBF and NMHG regained popularity, with significantly improved volume in late half of August and discount/premium, however market participants believed that the current level was close to roof area as there were not enough room on the steel margin left. Thus, low grade and discount iron ores including JMBF regained market interest with narrowing discounts. ITG sold 150,000mt PBF to Majestic Rock Resources Group during MOC at October Index + $0.45. CSN sold multiple laycans of IOC6 at October Index with a discount of $4.75, currently market saw improving interest in high silica products.

Australia and Brazil total delivered 25.42 million tons of iron ore, up 1.677 million tons on the week. Australia delivered 18.69 million tons, up 1.27 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Sep 21st)

Futures 105,244,600 tons(Increase 1,588,900 tons)

Options 91,974,100 tons(Increase 715,000 tons)

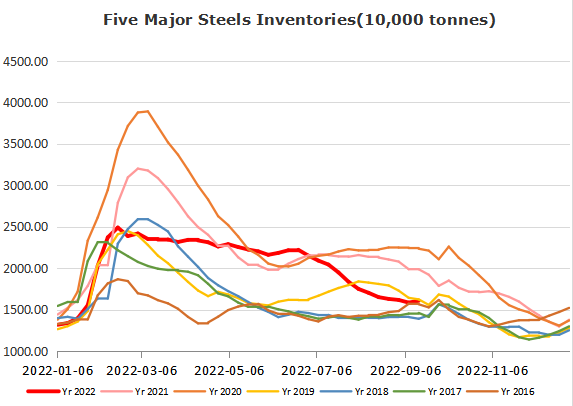

Steel Key Indicators

Tangshan average billet cost 3741 yuan/ton, down 24 yuan/ton on the week. Average production loss at 151 yuan/ton.

Shagang Group maintained unchanged on rebar for late September at 4200 yuan/ton.

Coal Indicators

Australia FOB coking coal up $6 yesterday to $256.5, leaving the $250 range, with a 75,000mt Goonyella PMV traded at $255.