Market Verdict on Iron Ore:

• Neutral.

Macro:

• The Beige Book of the Federal Reserve said that enterprises were more pessimistic about the economic outlook, but the inflation pressure eased.

• Eurozone September CPI annual growth rate up 9.9%, est. 10%, last 9.1%. U.K. September CPI annual growth rate up 10.1%, est. 10%, last 9.9%.

Iron Ore Key Indicators:

• Platts62 $93.75, -1.05, MTD $95.62. The trade activities on seaborne market return to stable mode with positive mid-grade trades, including MACF, PBF and NMHG seeing this week. However BRBF and IOCJ would potentially correct compared to other discount ores or mid-grade because of the extreme low margin in Chinese mills. Lump market was quiet because the speculation following meeting and production curb called an end in October.

• BHP iron ore production 72.1 million tons in Q3, up 1% from Q2, up 2% from last year.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 19th)

• Futures 97,506,200 tons(Increase 902,100 tons)

• Options 84,897,400 tons(Increase 1,195,000 tons)

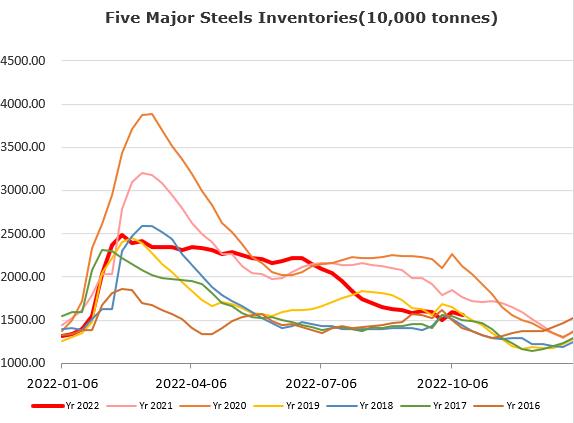

Steel Key Indicators:

• Tangshan average pig iron cost 2942 yuan, billet cost 3818 yuan/ton, down 30 yuan on the week. Average loss at 198 yuan/ton on steel production, increased 20 yuan/ton from last week.

Coal Indicators:

• FOB Australia coking coal traded at $294, concerning the supply tension. A deal was done at $288.25/mt FOB Australia for 30,000 mt of PLV Peak Downs with a Nov. 15–24 loading laycan. A bid was observed at $292 for 75,000mt GlobalBOAL HCCA Goonyella with early December laycan.