Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. dollar index depreciated fast from 113.93 to 109.53 since Oct 21st. Non-U.S. currency appreciated significantly during this week. Chinese yuan appreciated over 1200 bps yesterday.

• World Bank: Due to the EU embargo, insurance and shipping restrictions, Russia’s oil exports may decrease by up to 2 million barrels per day. It is estimated that the energy price will decline by 11% in 2023 after rising by 60% in 2022, but still 75% higher than the average level in the past five years.

Iron Ore Key Indicators:

• Platts62 $87.80, -1.70, MTD $94.40. PBF float premium massively corrected from $2.35 to $1.05 last Friday, because of the weakened Chinese steel margin lowered demand on high premium. Mills and traders were sensitive about the float premium. However Chinese pig iron production was stablised on a 2.4 million tons during the current three weeks, a potential high in H2 2022. BHP narrowed MACF discount in November from 2.5% to 0%, narrowed JMBF discount from 6.5% to 4.5%. Thus, Chinese steel mills indicated that it would take more times to get acquainted with the increased cost from BHP sources.

SGX Iron Ore 62% Futures& Options Open Interest (Oct 26th)

• Futures 100,242,000 tons(Decrease 290,500 tons)

• Options 92,719,400 tons(Increase 4,389,000 tons)

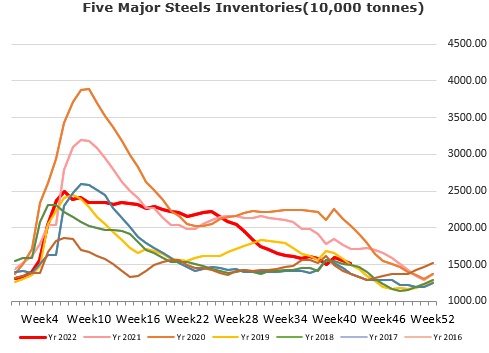

Steel Key Indicators:

• Tangshan mills average pig iron cost 2939 yuan/ton, average billet cost 3815 yuan/ton, down 3 yuan/ton. Average production loss at 235 yuan/ton.

Coal Indicators:

• FOB Australia coking coal rebounded significantly yesterday by $73.75 to $306.75 after a quiet week, because of an HCCA bid increased to $305. No trade was reported. Chinese import margin squeezed, which limited the CFR market growth.