Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• Chinese governors launched speech in Import Expo that China would promote all countries to share the country’s market opportunities, accelerate the construction of a bigger domestic market, optimize the trade mechanism, innovate the trade and services, and expand the import of high-quality products.

• U.S. Federal officials indicated that the Federal would consider to slow down the interest hike in next FOMC although the October U.S. job statistics increased significantly.

Iron Ore Key Indicators:

• Platts62 $88.05, +4.30, MTD $83.75. The poor steel margin in Chinese steel mills limited the interest in seaborne iron ores. Industrial buyers were not motivated by the macro sentiments recovery. Steel mills tolerance to Alumina impurities improved, 1-2.5% aluminum decreased by 30 cents to $1.7. MACF demand muted as the discount failed to reach the market expectations.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 4th)

• Futures 96,450,900 tons(Increase 2,217,900 tons)

• Options 81,704,700 tons(Increase 292,900 tons)

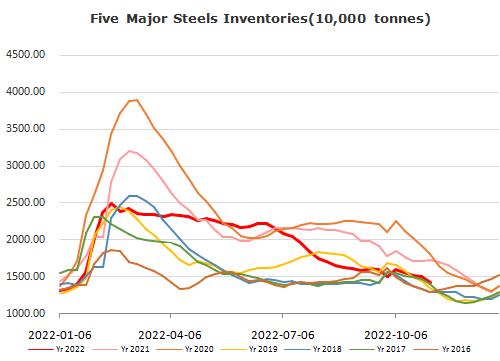

Steel Key Indicators:

• 247 sample Chinese blast furnace utilisation rate 78.77%, down 2.71% on the week, up 7.88% on the year. Operation rate 86.31%, down 1.32% on the week, up 9.88% on the year.

Coal Indicators:

• A deal concluded at $320 FOB Australia for 40,000mt of globalCOAL HCCA branded, which further lifted index.