Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• The vice president of ECB Luis de Guindos indicated that the bank would maintain interest increase till the inflation return to stable mode. The inflation rate expected to reach 10.7% and decrease from mid-2023.

• China October PPI down 1.3% on the year, September 0.9%. CPI October up 2.1% on the year, down 0.7% on the month.

Iron Ore Key Indicators:

• Platts62 $89.55, +0.50, MTD $85.94.The poor steel margin in Chinese steel mills limited the interest in seaborne iron ores. Industrial buyers were not motivated by the macro sentiments recovery. Steel mills tolerance to Alumina impurities improved, 1-2.5% aluminum decreased by 30 cents to $1.7. MACF demand muted as the discount failed to reach the market expectations.

• At the 5th China International Import Expo, Vale signed MOU Liaoning Port Co., Ltd., the operator of Dalian Port. Rio Tinto Group signed MOU with China Mineral Resources Group Co., Ltd.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 9th)

• Futures 99,219,600 tons(Increase 811,800 tons)

• Options 82,130,200 tons(Increase 245,000 tons)

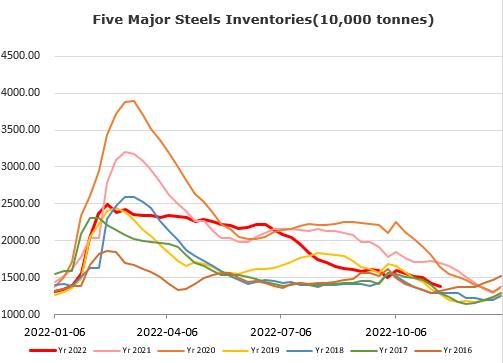

Steel Key Indicators:

• Tangshan average billet cost 3660 yuan/ton, down 57 yuan/ton on the week. Average loss at 170 yuan/ton.

Coal Indicators:

• A deal concluded at $320 FOB Australia for 40,000mt of globalCOAL HCCA branded last week, lifted index. The market returned to quiet mode this week with flat index.

• Tangshan steel mills started to third round of price cut by 100 yuan/ton.