Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• European Commission sent the Autumn economy outlook 2022, expected the GDP growth in 2022 at 3.3% in EU, GDP growth in 2023 at 0.3%. The report expected the inflation rate in EU countries in 2022 and 2023 at 9.3% and 7% respectively.

• Hernandez Decos, the governing committee of the European Central Bank, said that the start date of quantitative tightening policy (QT) may be announced at the meeting in December.

Iron Ore Key Indicators:

• Platts62 $92.25, +4.10, MTD $86.88. The poor steel margin in Chinese steel mills limited the interest in seaborne iron ores. Industrial buyers were not motivated by the macro sentiments recovery. Steel mills tolerance to Alumina impurities improved, 1-2.5% aluminum decreased by 30 cents to $1.7. MACF demand muted as the discount failed to reach the market expectations.

• At the 5th China International Import Expo, Vale signed MOU Liaoning Port Co., Ltd., the operator of Dalian Port. Rio Tinto Group signed MOU with China Mineral Resources Group Co., Ltd.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 11th)

• Futures 106,093,400 tons(Increase 1,995,600 tons)

• Options 83,367,000 tons(Increase 455,800 tons)

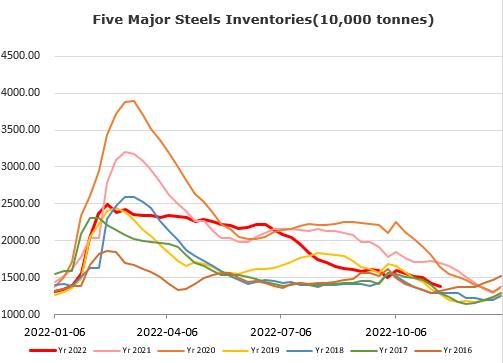

Steel Key Indicators:

• Tangshan average billet cost 3660 yuan/ton, down 57 yuan/ton on the week. Average loss at 170 yuan/ton.

Coal Indicators:

• The FOB Australia PLV Index down $20.5 at $300/mt as expected. The continuous lower trade dragged down the index price and indicated the real demand was more volatile around $280-290 instead of above $300. Asian mills indicative bids at $280 – 290.

• Chinese steel mills started to third round of price cut on met coke by 100 yuan/ton.