Market Verdict on Iron Ore:

• Neutral.

Macro:

• Multiple Chinese departments indicated that to support housing development and resolve financing and restructures.

• U.S. houses sales decreased for nine month consecutively, however house price up 128 months consecutively. The 30-year mortgage rate reached 20-year-high.

Iron Ore Key Indicators:

• Platts62 $96.25, -2.85, MTD $90.98. The seaborne market saw less bids although macro environment recovered during last two weeks. PBF and NHGF were fixed in the late half of last week. India announced to cut export duties from 45-50% to 30% on the iron ore and pellets with ferrous grade below 58%. Previously, Chinese iron ore import from India down 70% during the first nine months because of tariff increase in May. MySteel estimated the India export would recover to 4.5- 5 million tons per month from December or next January.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 21st)

• Futures 118,711,800 tons(Increase 1,011,400 tons)

• Options 91,355,900 tons(Increase 980,000 tons)

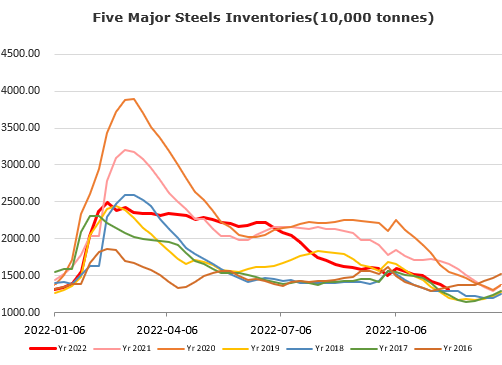

Steel Key Indicators:

• China Zenith ex-factory rebar up 50 yuan/ton in late November at 3950 yuan/ton.

Coal Indicators:

• Chinese major cokery plants proposed to increase offer by 100 yuan/ton because of the loss, yet to wait mills response.