Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• China CSRC spokesman supported the refinancing function of properties and related listed companies.

• China NBS: China industrial valued added amount above designated scale reached 6.98 trillion yuan from January to October, down 3% on the year. The ferrous metallurgical industries down 92.7% on the year.

Iron Ore Key Indicators:

• Platts62 $98.90, -0.75, MTD $92.46. China CSRC reopened the refinancing of property companies, the continuous sentiment on the Chinese local bank support house deliveries, supported the continuous growth of ferrous complex. PBF float was stable from $0.46-0.5 this week. MACF saw several trades from $94-95 this week. The month spread in SGX expected to maintain resilient supported by higher base on outright as well as improved market sentiment on current months.

SGX Iron Ore 62% Futures& Options Open Interest (Nov 28th)

• Futures 123,248,200 tons(Increase 753,400 tons)

• Options 98,731,600 tons(Increase 405,000 tons)

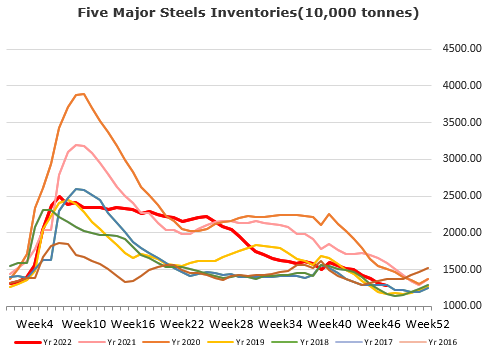

Steel Key Indicators:

• MySteel surveyed steel mills winter stock scrap at 1.05 million tons, down 23.36% on the year.

Coal Indicators:

• Australia FOB market consolidated from $245-247.Tradable levels were heard in the $240-250/mt FOB Australia for December loading. The index was linked to massive trade at $246.5 for Goonyella PMV at current days.