Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• China Jan- Nov local debts issuance reached 7.3 trillion yuan, a historical high.

• Many cities in China eased off the pandemic control in early this week, including optimise the PCR test, travel, and medical purchase.

Iron Ore Key Indicators:

• Platts62 $109.60, +2.30, MTD $106.67. The steel mill entered a stocking period, however the total amount was limited because of the demand was almost fixed given a stable number of pig iron production versus surveyed willingness of downstream market. PBF float ranged from $0.6 – 0.65/mt, however NHGF was smaller. Front month spread missed the whole round of big spike on outright during past two weeks, because market was generally positive on the Q1 market in 2023 instead of Q4 2022.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 5th)

• Futures 96,548,000 tons(Increase 692,100 tons)

• Options 79,008,300 tons(Increase 796,000 tons)

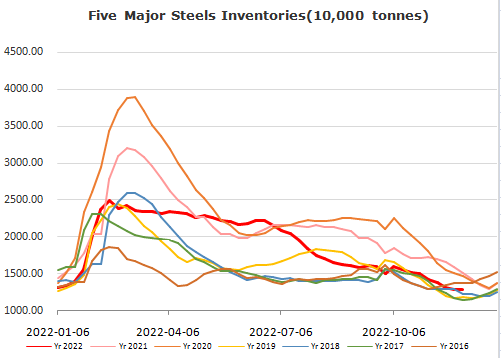

Steel Key Indicators:

• POSCO CEO estimated global steel demand in 2023 reached 1%, steel industry expected to recover in H2 2023.

Coal Indicators:

• Australia FOB market maintained strong at $249-250, supported by the wet weather impact on eastern Australia PMV supply. PCI was restricted by Russian railway supply issue as well. Chinese cokery plants increased physical coke for two rounds totaled growth 200-220 yuan/mt.