Market Verdict on Iron Ore:

• Neutral.

Macro:

• China state council published new measures on the pandemic control, which require no PCR test to public areas except schools, hospital and some densely populated areas. Travelling persons are not required to provide PCR test results and new tests.

• Canada central bank would raise interest rate by 50 bps, indicated the interest hike would reach an end.

Iron Ore Key Indicators:

• Platts62 $107.45, -2.25, MTD $107.43. The steel mill entered a stocking period, however the total amount was limited because of the demand was almost fixed given a stable number of pig iron production versus surveyed willingness of downstream market. PBF float ranged from $0.5 – 0.55/mt, however NHGF was smaller. Front month spread missed the whole round of big spike on outright during past two weeks, because market was generally positive on the Q1 market in 2023 instead of Q4 2022.

• DCE increased deliverable iron ore brands including Taigang concentrates, Magang concentrates, China Mineral concentrates and SP10.

• Vale decreased long-run iron ore production target in 2030 from 400 million tons to 360 million tons, however increased ferrous grade from 62.3% to 62.9%. The company expected to increase the Fe grade to 63.5% in 2026 and 64% in 2030.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 7th)

• Futures 97,794,300 tons(Increase 1,246,300 tons)

• Options 79,595,800 tons(Increase 587,500 tons)

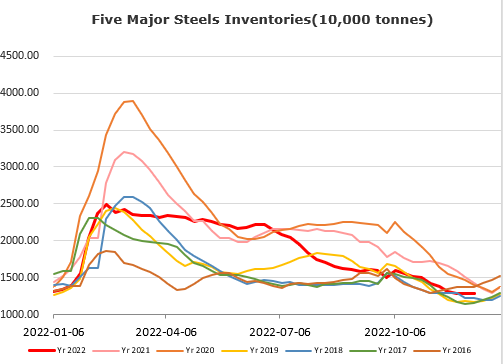

Steel Key Indicators:

• Tangshan average billet cost 3751 yuan/ton, up 47 yuan/ton on the week, average loss at 121 yuan/ton.

Coal Indicators:

• Australia FOB market maintained strong at $249-250, supported by the wet weather impact on eastern Australia PMV supply. PCI was restricted by Russian railway supply issue as well. Chinese cokery plants increased physical coke for two rounds totaled growth 200-220 yuan/mt.