Market Verdict on Iron Ore:

• Neutral.

Macro:

• ECB: Estimated GDP growth in 2022 at 3.4%, est. 3.1%. GDP growth in 2023 at 0.5%, est. 0.9%. GDP growth in 2024 at 1.9%, est. 1.9%.

• Dow Jones Index created the biggest single day correction over last three month. U.S. November retail sales drop exceeding the market expectation, triggered a new round of concerns on the recession. Dow Jones corrected 2.25% to 33202.22.

Iron Ore Key Indicators:

• Platts62 $113.15, +3.40, MTD $109.43. The physical trades fell into seaborne mid-grade this week. The market saw FMG SSF traded at index and discount of 13%, however participants believed more discounts potentially happen given India export from inroads to China only traded at 22-23% discount. Yandi traded at January index and a discount of $6.05. CSN IOC6 Fe61.85% traded at index and $4.05 discount. JMBF traded at Index and $5.6 discount.

• PBF was traded in fixed price a t $110.15. JMBF was traded at a $5.6 discount based on January average. China traders indicated expecting no more curbs in winter, to catch up building and manufacturing impacted by pandemic during most time of the year. India fines were active in Asia, with 22-23% discount at IODEX January Index, which potentially generate pressure to FMG or other low grade market. Chinese concentrates supply expected to increase as the loosening of pandemic control and normalisation of transportation.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 15th)

• Futures 104,118,800 tons(Increase 1,472,800 tons)

• Options 84,117,900 tons(Increase 912,600 tons)

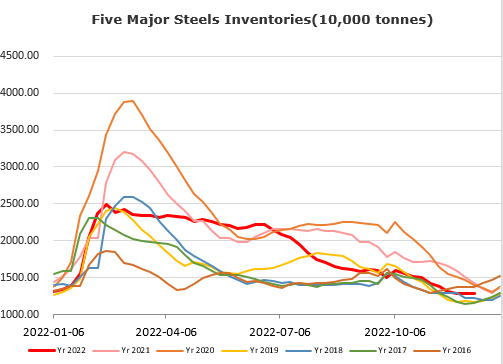

Steel Key Indicators:

• Mysteel researched 247 blast furnace operation rate at 75.97%, up 0.07% w-o-w, up 7.97% on the year. Utilisation rate 82.64%, up 0.63% w-o-w, up 8.36% on the year. Daily pig iron production 2.22 million tonnes, up 17,200 tonnes.

Coal Indicators:

• Australia FOB marketmaintained strong at $247-250, supported by the wet weather impact on eastern Australia PMV supply.