Market Verdict on Iron Ore:

• Neutral.

Macro:

• As of January 8th, the PCR test of all entry personnel in China will be cancelled.

• U.S. housing growth rate decreased from 11.1% in September to 9.8% in October, created the slowest growth rate since September 2020.

Iron Ore Key Indicators:

• Platts62 $114.75, +0.10, MTD $110.73. With seasonal low stock level at Chinese steel mills, PBF concluded three deals with high float basis at $2.05-2.25/dmt. Other mid-grade saw significant improvement on float basis prices as well.

SGX Iron Ore 62% Futures& Options Open Interest (Dec 28th)

l Futures 109,569,300 tons(Increase 393,000 tons)

• Options 86,653,300 tons(Increase 274,000 tons)

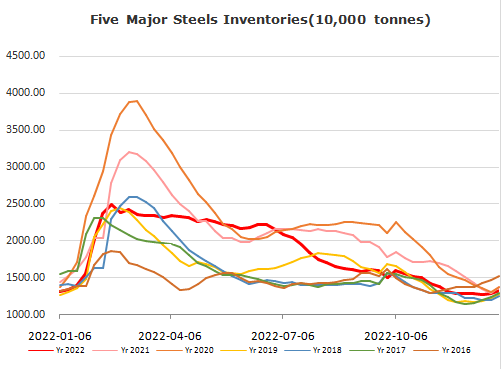

Steel Key Indicators:

• MySteel researched daily pig iron production at 2.25million tons in next January, with current production level at 2.2-2.21 million tons.

• Tangshan average billet cost 3038 yuan/ton, average loss at 158 yuan/ton, narrowed 27 yuan/ton on the loss.

Coal Indicators:

• Australia FOB PLV market was flat in early half of the week. The market saw a bid at $285 for Peak Downs HCCLV, for February laycan. Indian end-users indicated that the real market was still at $250-260 level instead of $280-285.