Market Verdict on Iron Ore:

• Neutral.

Macro:

• BOE increased interest rate by 50 bps at 4%, refreshed highest since October 2008. ECB increased interest rate by 50 bps to 3%.

Iron Ore Key Indicators:

• Platts62 $126.70, -2.25.The yesterday market slumped following the China-Australia talk, traders expect more iron ore import or more bulk trades between the two countries. Physical market started to see great volume today after the derivatives market saw a consecutive correction for two trading days. JMBF and Yandi discount were similar to mid-January. Thus, the fixed price was rather high with bubbles created during Chinese holiday with no real trade. In addition, import margin became negative again, which potentially limit the growth of the index. The import loss of 40-50 yuan limited the further growth of spot seaborne cargoes.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 2nd)

l Futures 96,204,400 tons(Increase 1,886,800 tons)

• Options 71,106,700 tons(Increase 692,200 tons)

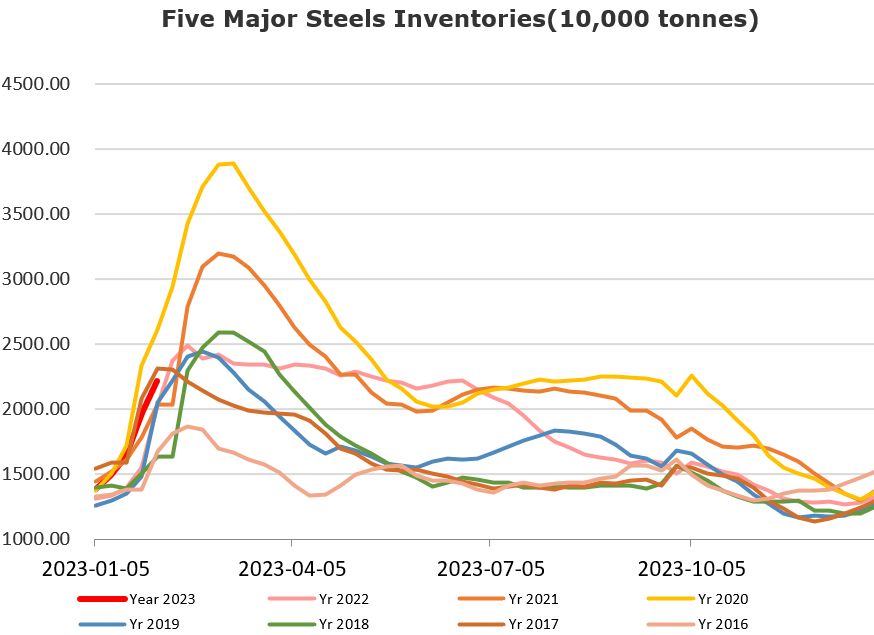

Steel Key Indicators:

• Tangshan average billet cost 3912 yuan/ton, up 55 yuan/ton on the week. Average loss 102 yuan/ton, improved 95 yuan/ton from last week.

Coal Indicators:

• JSW tender saw firm higher bids from three buyers yesterday, however didn’t award the tender. The strong buying interest support index of Australia FOB coking coal increasing by $15 to $350/mt.