Market Verdict on Iron Ore:

• Neutral to bearish.

Macro:

• China state council outlined a quality improvement in “Chinese Brand”, including upgrading qualities in steels, glasses, ceramics, promoting green steels.

• Bloomberg: U.S. planned 200% tariff on Russia Aluminum as soon as this week.

Iron Ore Key Indicators:

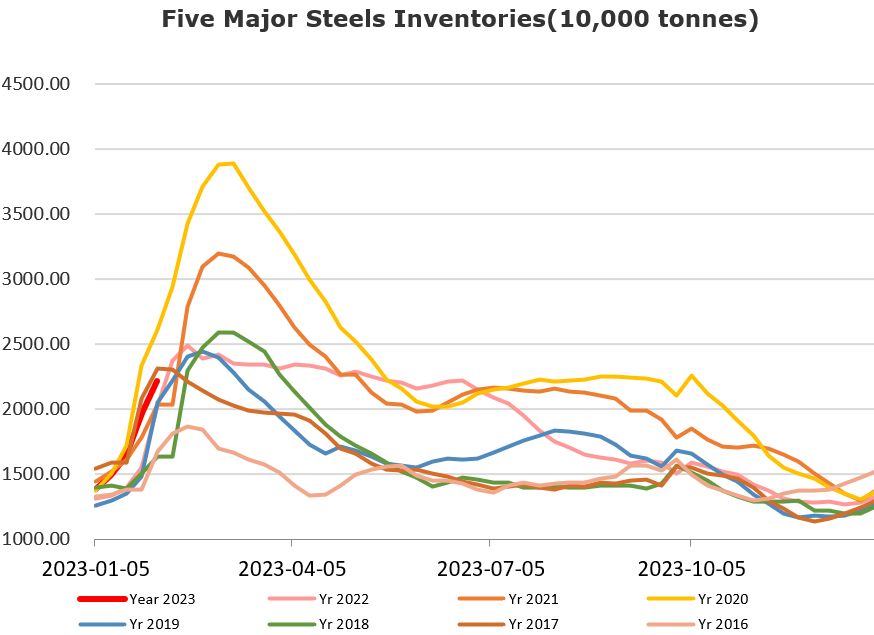

• Platts62 $124.05, -2.20, MTD $125.54. Chinese steel mills iron ore stock level was low, compared with last three years. Thus, restocking expected to increase in the next few weeks. However secondary iron ore sales meet with difficulties given an import loss in Chinese ports. As a result, premiums saw significant pressure.

• MySteel researched Chinese 45 ports iron ore arrivals at 23.65 million tons, down 688,000 tons on the week. Six northern ports arrivals at 10.98 million tons, down 2.869 million tons.

• MySteel researched Australia and Brazil iron ore deliveries at 24.549 million tons up 2.966 million tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 6th)

• Futures 100,774,100 tons(Increase 792,200 tons)

• Options 74,320,500 tons(Increase 1,181,000 tons)

Steel Key Indicators:

• Both Shangang Group and Yonggang Group increased Chinese 2023-F1 scrap price(heavy scrap) by 80 yuan/ton effective from February 7th.

Coal Indicators:

• There was cyclones approach Queensland port areas, expected to impact deliveries of coal. PLV offer increased at least $10 concerning the potential supply disruption.