Market Verdict on Iron Ore:

• Neutral.

Macro:

• European Central Bank president Christine Lagarde indicated that high inflation would create huge impact in economy and target to bring inflation back to 2%. The ECB officials are proposing 50 bps interest raise in March.

• China MIIT urged to increase the merging and restructure of domestic steel industries, improving the quality of steels.

Iron Ore Key Indicators:

• Platts62 $127.30, +2.55, MTD $124.58. Fixed trades in mid-stream largely represent the strong physical market sentiment. Seaborne trades became popular again with steel sales improved during past few days. Rio Tinto sold PBF at $126. Vale sold BRBF at $130. The premium sales of PBF stood at IODEX April + $1.3.

• Vale sales of iron ore fines at 260.6 million tons in 2022, down from 270.93 milliojn tons in 2021. Iron ore pellets sales rose to 33.16 million mt in 2022 from 32.21 million mt in 2021. C1 cash costs rose to $19/mt in 2022, from $16.5 in 2021.

• According to the announcement of market risk warning issued by DCE, to avoid huge market risk, market participants are required to participate rationally and in compliance to prevent and control risks, to ensure the stablisation of market.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 17th)

• Futures 111,501,400 tons(Increase 3,535,900 tons)

• Options 83,805,600 tons(Increase 790,000 tons)

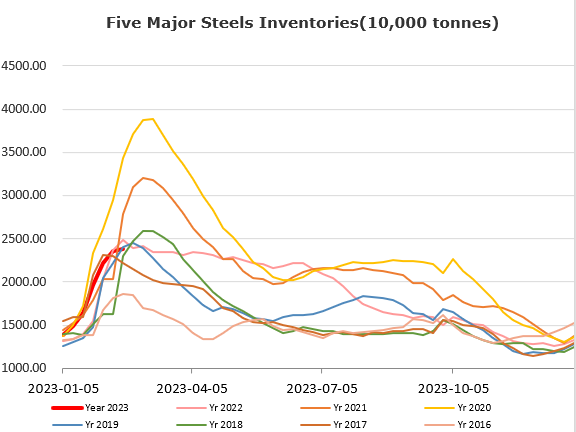

Steel Key Indicators:

• MySteel researched 137 sample mills rebar production 2.63 million tons, up 172,400 tons on the week.

Coal Indicators:

• A bid was heard at $405 for 40,000mt HCCA branded coal for few days, but no trade was reported yet. The PLV market was waiting for direction and become quiet.