Market Verdict on Iron Ore:

• Neutral.

Macro:

• The central bank of Germany indicated that Germany economy expected to recover in particular after the resilience growth rate of last Q4. However it would take more time to moderate high consumer price.

Iron Ore Key Indicators:

• Platts62 $129.55, +2.25, MTD $124.94. Fixed price still dominate the market from late half of last week to early half of this week. The import margin vanished again for mid-grade and high grade as the quick push on iron ore index, which squeezed PBF premium to a $0.4-0.7 area. Port trades volume recovered, however be aware of low pig iron growth could become resistance factors of the fast growth.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 20th)

• Futures 113,435,400 tons(Increase 6,343,900 tons)

• Options 84,245,600 tons(Increase 2,459,300tons)

Steel Key Indicators:

• Shagang Group increased scrap price by 50 yuan/ton.

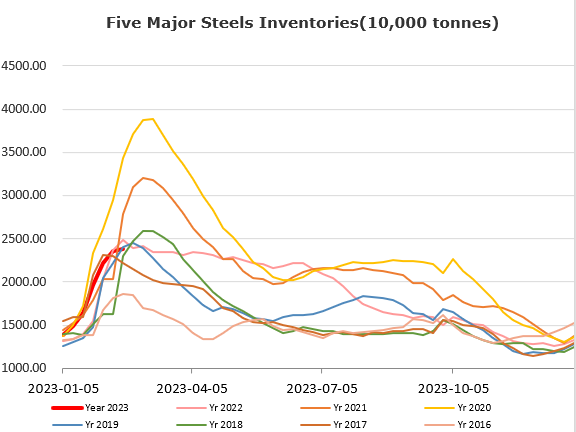

• CISA statistic indicated that member steel mills daily production 2.06 million tons in early February, up 3.77% from late January. Steel inventories 18.03 million tons, up 9.36% from late January.

Coal Indicators:

• The highest bid over Saraji and Peak Downs PLV were heard at $390/mt.

• The clearance of coals from port Ceke expected to reach 20 million tons, Australia coal production expected to increase 10.1 million tons. Thus, the coal expected to have a loose supply in 2023 in Asia.