Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. jobless claims fell to unexpected 192,000, estimated 200,000.

Iron Ore Key Indicators:

• Platts62 $130.20, -0.40, MTD $125.99. Fixed price still dominate the market in current two weeks. The import margin vanished again for mid-grade and high grade as the quick push on iron ore index. PBF premium in March was $0.6, and $1.25 in April. Port trades volume in China recovered, pig iron production was following a seasonal growth trend.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 23rd)

• Futures 116,386,600 tons(Increase 184,800 tons)

• Options 88,970,100 tons(Increase 675,000 tons)

Steel Key Indicators:

• 40 independent EAFs average steel cost 4267 yuan/ton, up 70 yuan on the week. Average profit 28 yuan/ton, down 17 yuan/ton on the week.

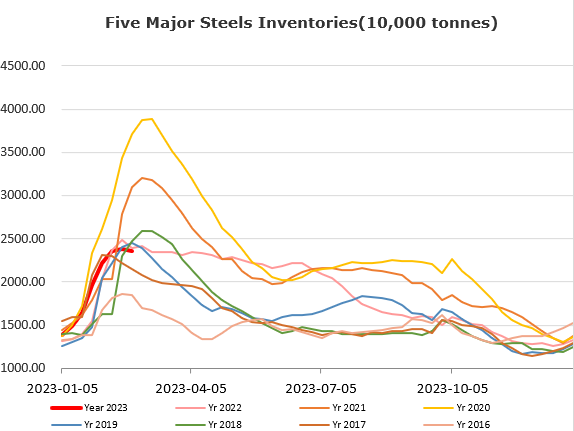

• CISA statistic indicated that daily average crude steel produciton reached 2.09 million tons, up 1.49% on the year in Mid-February. Steel inventories at 19.53 million tons, up 1.5 million tons from early February, or 8.32%.

Coal Indicators:

• The FOB Australia market started correction mode after the logistric bottleneck was resolved, the market saw PHCC offer at $375.

• The Chinese coal mine accident impact was estimated limited. The miner produced 1/3 soft coking coals and few thermal coals, with total 900,000 tons capacity per year.