Market Verdict on Iron Ore:

• Neutral to bearish.

Macro:

• CNH and CNY depreciated to 6.98 and 6.96 respectively, both refreshed new highs in 2023.

• U.S. January PCE up 0.6% on the year, refreshed the biggest increase since August 2022, est. 0.4%, last 0.3%.

Iron Ore Key Indicators:

• Platts62 $126.65, -3.55, MTD $126.03. A Chinese trader indicated that he heard discount trade on PBF March laycan to clear stocks. Mid-grade demand shift to discount cargoes again. Moreover, Chinese pig iron production failed to create an over-expected growth compared to same period during last few years. Pellets maintained weak as seaborne price has becoming way more expensive than portside.

• Tangshan started Level II Air Pollution Alert from February 25th, expected to impact 30-50% sintering production in major mills.

SGX Iron Ore 62% Futures& Options Open Interest (Feb 23rd)

• Futures 118,145,400 tons(Increase 1,758,800 tons)

• Options 89,817,600 tons(Increase 847,500 tons)

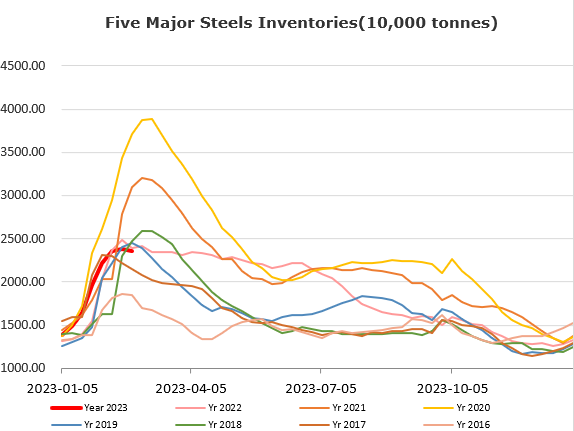

Steel Key Indicators:

• Tangshan average billet cost 3953 yuan/ton, up 58 yuan/ton. Production loss at 23 yuan/ton in blast furnace.

Coal Indicators:

• The FOB Australia coking coal market started to collapse after supply recovered significantly, with current highest trade seen was PMV Goonyella April laycan reported done at $347.