Market Verdict on Iron Ore:

• Neutral.

Macro:

• MySteel estimated that China manufacturing orders potentially recover, while the cash flow expected to improve. Mysteel estimated the investment of manufacturing would increase by 6%.

• Robert Holzmann, the ECB’s governing committee, told the German Business Daily that the ECB should raise interest rates by 50 basis points each time in the next four meetings, because inflation has proved stubborn.

Iron Ore Key Indicators:

• Platts62 $125.35, -2.10, MTD $126.71. The market rumor said NDRC pricing department had a meeting yesterday with Qingdao Port company, without mentioning further details. Previously, China NDRC held conference to discuss the strategies on the fast increased iron ore price. It is the third NDRC notice on iron ore during the year. Some market participants believed that there would be more details or strategies held out to counter against fast increasing material cost through the year.

• Mysteel Australia and Brazil 19 ports iron ore delivery at 24.61 million tons, up 684,000 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 6th)

• Futures 97,839,300 tons(Increase 1,776,900 tons)

• Options 76,722,100 tons(Increase 230,000 tons)

Steel Key Indicators:

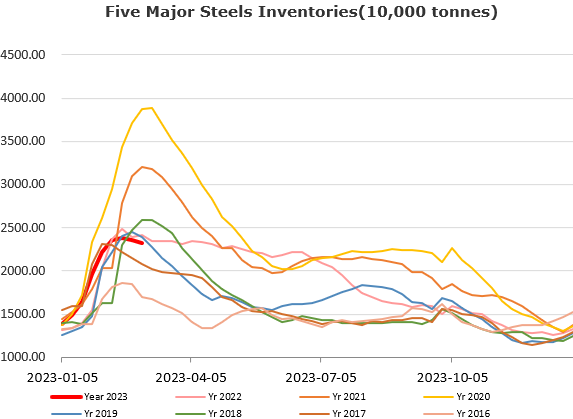

• CISA statistics indicated that steel inventories reached 33.25 million tons at February, up 18.5% from late January, up 6.9% on the year.

Coal Indicators:

l In Australia market, a bid heard at $360/mt FOB Australia for 40,000mt of globalCOAL HCCA Branded coal for April laycan, while an offer at $375/mt for HCCA Unbranded coal was heard for similar laycan.

l Shanxi and Innner Mongolia province in China increased physical coke price by 100-110 yuan/ton.