Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. January ADP new added jobs 242,000, higher than expected 200,000. Job vacancies in the month dropped to 10.8 million.

• China January CPI up 1% on the year, estimated 1.9%, last 2.1%. China January PPI down 1.4% on the year, estimated 1.3%, last down 0.8%.

Iron Ore Key Indicators:

• Platts62 $127.90, -0.10, MTD $127.13. MB65-P62 spread maintained low at 1.11-1.12 during Q1, mills started to purchase some high grade as the high cost-effectiveness on the background of construction season in China. Moreover, IOCJ-BRBF reached a low area in history. On the otherside, low grade has narrowed discount for twice in 2023. However both IOCJ and BRBF were traded actively in fixed price during this week, as the supply of Brazil saw a significant recovery compared to February.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 8th)

• Futures 100,658,600 tons(Increase 1,094,200 tons)

• Options 78,282,100 tons(Increase 385,000 tons)

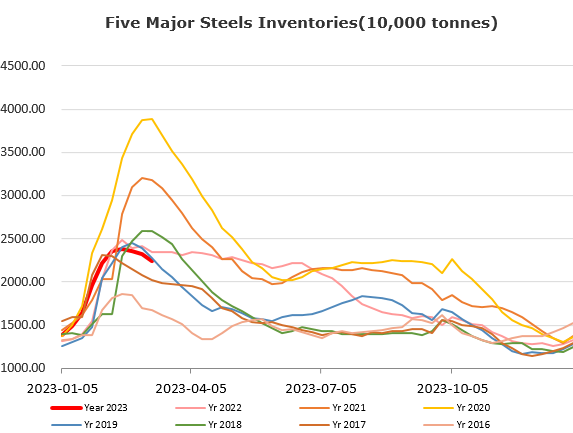

Steel Key Indicators:

• Tangshan average billet cost 3964 yuan/ton, up 45 yuan/ton on the week. Average profit margin 6 yuan/ton, up 5 yuan/ton on the week.

Coal Indicators:

• Seaborne HCC PLV fell marginally as market participants indicated weaker buying interest, offers became softer from $300-330/mt.