Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. February non-farm payroll increased by 311,000, estimated up 225,000, last 517,000. U.S. February jobless rate at 3.6%, est. 3.4%, last 3.4%.

• U.S. federal reserve announced emergency bank financing program(BTFP). The Ministry of Finance will provide $25 billion to support bank loans. According to Fed Watch, the probability of 50 bps interest hike fell from 75% to 10%.

Iron Ore Key Indicators:

• Platts62 $129.95, +0.95, MTD $127.71. The secondary market saw active trades, PBF premium for March and April were at $1, which was high considering a fast increased index. BHP sold JMBF at $4.7 discount. In general, the market saw improved PBF premium and narrowed BHP discount, because of the recovered steel margin.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 10th)

• Futures 100,658,600 tons(Increase 1,094,200 tons)

• Options 78,282,100 tons(Increase 385,000 tons)

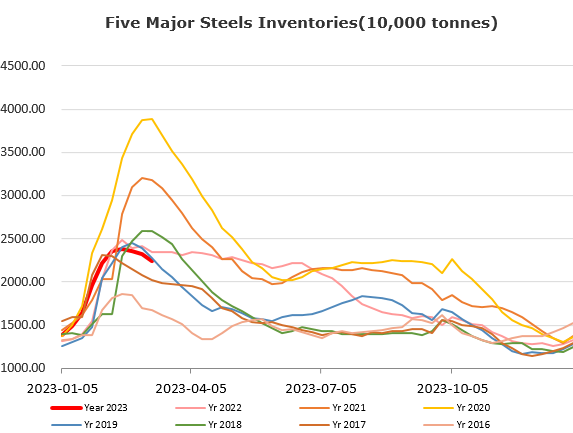

Steel Key Indicators:

• Brazil’s Vice President Geraldo Alckmin announced through social media that Brazil would cancel import tariffs on six commodities from March 10th. These six commodities include two different types of steel, two types of aluminum plates, bracelets for measuring blood pressure, and radar antennas.

Coal Indicators:

• Australia Goonyella and Caval Ridge traded at $363/mt, laycans concentrated in late March and early April.