Market Verdict on Iron Ore:

• Neutral.

Macro:

• The U.S. recorded an annual CPI of 6% in February without quarterly adjustment, which has declined for the eighth consecutive month and is the lowest since September 2021. The monthly CPI rate of the U.S. recorded 0.4% after the quarterly adjustment in February, the lowest since December 2022. The core CPI annual rate recorded 5.5% in February without quarterly adjustment, which has declined for the sixth consecutive month and is the lowest since December 2021.

• US financial market prices show that the US Federal Reserve is expected to raise interest rates by 25 basis points next week, and raise interest rates by the same rate again in May, after the government report showed that US consumer prices rose steadily in February. The pricing of the federal funds futures market shows that the probability of raising interest rates by 25 basis points this month is about 90%, and the probability of maintaining interest rates unchanged is about 10%.

Iron Ore Key Indicators:

• Platts62 $133.00, +0.65, MTD $128.71. The secondary market saw active trades, PBF premium for May at $1.45, which was high considering a fast increased index. PBF premium raised fast from $0.8 to $1.45 during the past two weeks. BHP sold JMBF at $4.5 discount, narrowed $0.2 during this week. In general, the market saw improved PBF premium and narrowed BHP discount, because of the recovered steel margin.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 14th)

• Futures 107,203,000 tons(Increase 1,145,700 tons)

• Options 84,951,600 tons(Increase 2,910,500 tons)

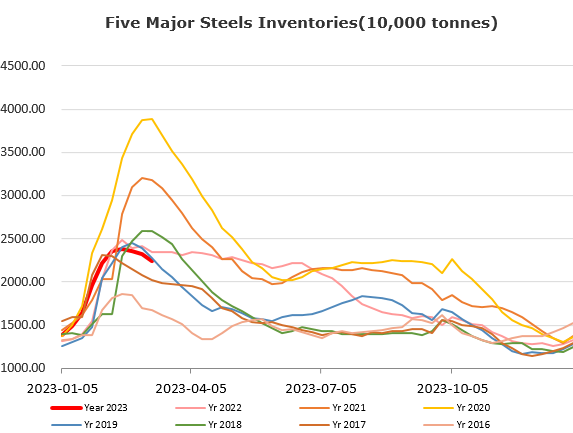

Steel Key Indicators:

• According to the National Bureau of Statistics, the average daily output of crude steel in China will be 2.8593 million tons from January to February 2023; The daily average output of pig iron is 2.4451 million tons; The average daily output of steel is 3.4954 million tons. China’s crude steel output in January-February was 168.7 million tons, up 5.6% year on year;