Market Verdict on Iron Ore:

• Neutral to Bearish.

Macro:

• China PBOC announced that it will cut Reserve Requirement Rate by 25 bps for Financial institutions starting from March 27th, viewed as a positive sign to the investment market.

• UBS to buy Credit Suisse in $3.3 billion to end crisis.

Iron Ore Key Indicators:

• Platts62 $132.00, +1.55, MTD $129.43. China NDRC pricing department started investigation in Tangshan port and Qingdao port. The department concerned about the mis-pricing, urged to increase supply on iron ore.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 17th)

• Futures 109,965,900 tons(Increase 2,762,900 tons)

• Options 100,528,100 tons(Increase 15,576,500 tons)

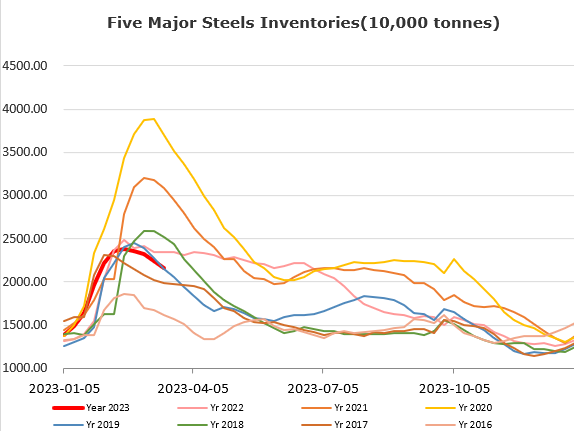

Steel Key Indicators:

• China Customs: China total exported 7.53 million tons of flat steel, up 39.8% on the year. China exported 1.75 million tons of long steel, up 129.4% on the year.

Coal Indicators:

• Australia PMV traded at $345/mt Goonyella with early April laycan. The deal came with $344 for Goonyella/Riverside/Caval Ridge with same quantity and laycan. The market was strengthened by a potential supply operational disruption from a major miner.