Market Verdict on Iron Ore:

• Neutral to Bearish.

Macro:

• CME FedWatch indicated that the 25 bps interest hike in March had reached 87.1%.

• U.S. Finance Minister said that if small banks encounter a run and risk out-spread, they are willing to intervene to protect deposits.

Iron Ore Key Indicators:

• Platts62 $124.70, -1.80, MTD $128.92. Roy Hill sold 190,000mt Medium Fine at March Index and discount o 9.25%, or April Index and 7.5% discount.

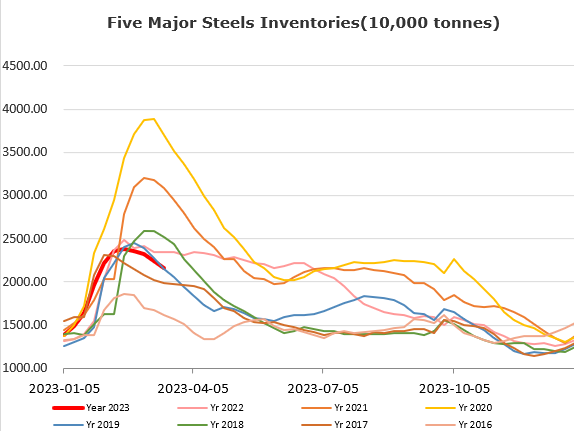

• Steel market saw a cool down on daily trading volume. Some mills are thinking about locking price for far months. Spot steel price fell suddenly, which left no margin on production side again.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 21st)

• Futures 111,937,100 tons(Increase 1,072,000 tons)

• Options106,661,600 tons(Increase 959,000 tons)

Steel Key Indicators:

• MySteel estimated that China March daily crude steel production rise by 1.12% on the month and 9.37% on the year to 2.98 million tons.

Coal Indicators:

• Australia FOB coking coal index maintained stable, with tradeable range from $320 – 340/mt.