Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. Market Manufacturing PMI at 49.3, refreshed the highest since October 2022, est. 47, last 47.3.

• China central bank PBOC officially cut RRR by 25 bps on March 27th, equivalent to 600 billion yuan of mid-term liquidity.

Iron Ore Key Indicators:

• Platts62 $121.10, +0.80, MTD $127.59. The resilient spot and forward demand on the downstream support physical market given a weak futures market last week. As previous expected, market gained support above $115-120 level. Previously, market participants showed strong fixed buying interest on such levels. The fall of index benefit the room of float price. PBF, NHGF and BRBF saw a significant pick up on the float premium.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 24th)

• Futures 108,100,900 tons(Decrease 1,824,700 tons)

• Options 108,927,100 tons(Increase 92,500 tons)

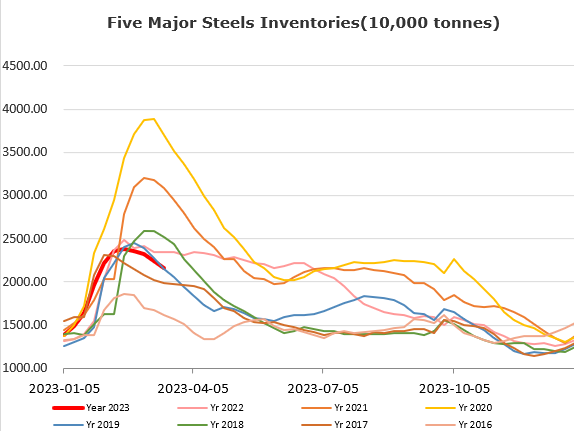

Steel Key Indicators:

• Tangshan average billet cost 3946 yuan/ton, down 43 yuan/ton. Average production loss at 46 yuan/ton.

Coal Indicators

• China Tariff Department of State Council announced to extend the 0 coal import tax from April 1st to December 1st 2023.