Market Verdict on Iron Ore:

• Neutral.

Macro:

• China Jan-Feb industrial net income above designated scale reached 887.21 billion yuan, down 22.9% on the year

• U.S. Insurance company FDIC said that First Citizens Bank & Trust Co. would take over all deposits and loans from Silicon Valley Bank (SVB), which may ease the market sentiment following the recent bank-run.

Iron Ore Key Indicators:

• Platts62 $121.65, +0.55, MTD $127.28. The resilient spot and forward demand on the downstream support physical market given a weak futures market last week. As previous expected, market gained support above $115-120 level. Previously, market participants showed strong fixed buying interest on such levels. PBF float premium based on May was $1.35.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 27th)

• Futures 108,100,900 tons(Decrease 882,200 tons)

• Options 109,541,600 tons(Increase 614,500 tons)

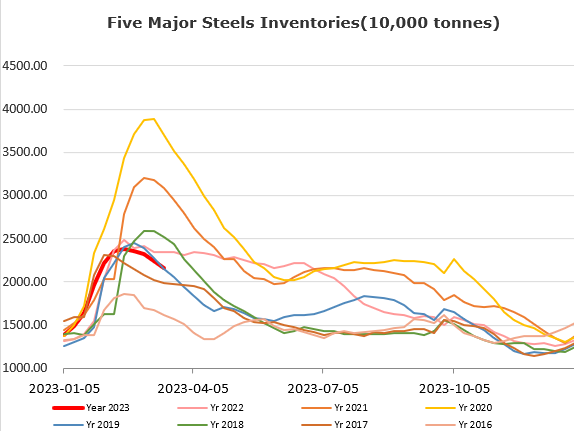

Steel Key Indicators:

• China pig iron and crude steel output over March 1- 20th were up 1% and 3.6% respectively at 2.387 million mt and 2.678 million mt compare to same period in February.

Coal Indicators:

• Australia FOB market saw correction by seeing softened offers and less bids on the market. Secondary quality coals are surplus on this market.