Market Verdict on Iron Ore:

• Neutral.

Macro:

• World Bank: Global economy growth rate potentially drop to the slowest since 2000, average growth rate at 2.2% from 2023 to 2030.

Iron Ore Key Indicators:

• Platts62 $125.10, +1.40, MTD $127.00. The iron ore market was back to normal as the risk appetite shift back. Physical trades on both float and fixed improved significantly. BHP sold MACF at $119.4, $1.1 lower than previous day. Rio Tinto once sold three laycans on Tuesday, and maitained active trade during this week. There were increasing IOCJ trades during past 2-3 weeks.

SGX Iron Ore 62% Futures& Options Open Interest (Mar 29th)

• Futures 108,444,300 tons(Increase778,100 tons)

• Options 113,349,100 tons(Increase 2,000,000 tons)

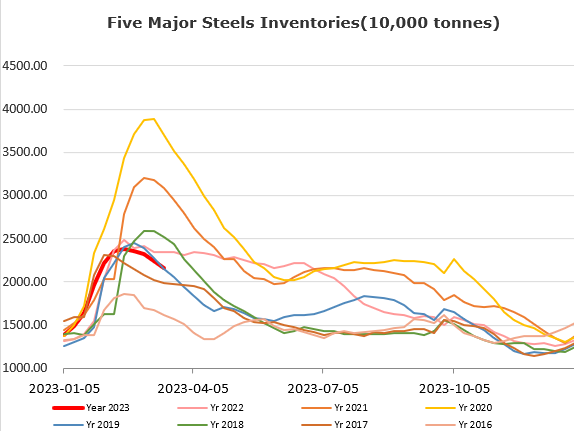

Steel Key Indicators:

• China Jan-Feb crude steel daily production at 2.8593 million tons, up 13.8% from last December. MySteel estimated crude steel production reach 2.95-3 million tons in March.

• Tangshan average billet cost 3902 yuan/ton, down 44 yuan/ton on the week. Average loss 22 yuan/ton, down 4 yaun/ton on the week.

Coal Indicators:

•Australia FOB market saw correction by seeing softened offers and less bids on the market. Secondary quality coals are surplus on this market.