Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. NAHB April index 45, last 44, est. 44. The improvement on the housing investment was contributed by the limited sources of second-hand houses on the market, as well as the lower mortgage rates, which stimulated the demand for new houses.

• China Q1 GDP amount at 28.4997 trillion yuan, up 4.5% from Q1 2022, up 2.2% from Q4 2022.

Iron Ore Key Indicators:

• Platts62 $120.00, +1.10, MTD $120.38. Physical traders expected active trading activities recovered. PBF float rebounded to $2 from $ 1 based on May average seeing from late March. MACF saw fixed trade and more enquiries. JMBF traded in narrower discount at $3 based on May index, which was a $3.8 in early April. Australia and Brazil total shipped 17.528 million tons of iron ore, down 5.99 million tons on the week, because of the cyclone closure in Australia ports.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 17th)

• Futures 95,393,000 tons(Increase 564,700 tons)

• Options 104,276,500 tons(Increase 1,471,000 tons)

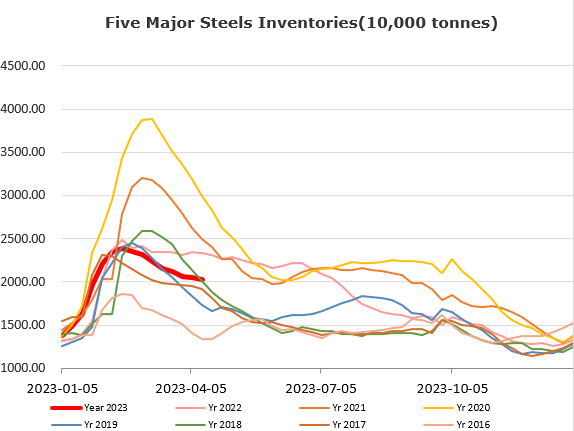

Steel Key Indicators:

• MySteel researched 18 EAFs in Guangdong province, which are all operating at marginal loss in producing steels.

• Brazil steel consumption estimated down 1% in 2023. Brazil export estimated to grow 7.6% in 2023.

Coal Indicators:

• China Hebei, Shandong major mills decreased coke price by 100 yuan/ton, total down 300 yuan/ton during the past three rounds.