Market Verdict on Iron Ore:

• Neutral.

Macro:

• U.S. Federal governor Raphael Bostic estimated the interest rate would maintain unchanged for a long period after the last hike in 2023. The Federal Reserve’s support for further interest rate hikes to cope with persistent inflation. The market has exaggerated concerns about economic recession.

• The European Parliament has voted to pass the EU carbon border tax, imposing carbon dioxide costs on imported steel, cement, aluminum, fertilizers, electricity, and hydrogen. Parliament supports the EU to reduce carbon market emissions by 62% from 2005 levels by 2030, provide free quotas for industrial carbon dioxide emissions by 2034.

Iron Ore Key Indicators:

• Platts62 $120.45, +0.45, MTD $120.39. Physical traders expected active trading activities recovered. PBF float rebounded to $2.65 from $ 1.3 based on June average seeing from late March. MACF saw fixed trade and more enquiries. JMBF traded in narrower discount at $3 based on May index, which was a $3.8 in early April.

• Vale Q1 iron ore production at 66.8 million tons, est. 67.7 million tons, last quarter 80.85 million tons.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 18th)

• Futures 97,148,500 tons(Increase 1,755,500 tons)

• Options 105,686,500 tons(Increase 1,410,000 tons)

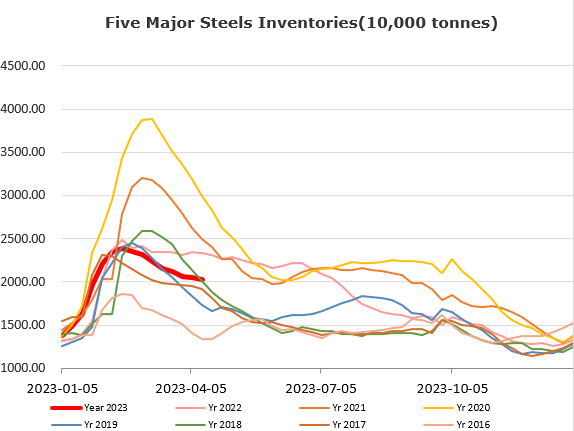

Steel Key Indicators:

• The World Iron and Steel Association predicted that global steel demand will increase by 2.3% to 1.822 billion tons in 2023, after previously predicting a 1% increase. It is expected that global steel demand will increase by 1.7% to 1.854 billion tons in 2024.

Coal Indicators:

• China Hebei, Shandong major mills decreased coke price by 100 yuan/ton, total down 300 yuan/ton during the past three rounds.