Market Verdict on Iron Ore:

• Neutral.

Macro:

• Wells Fargo Bank recently predicted that the US economy will enter a recession later this year, but the Federal Reserve will not lower interest rates this year. The bank expected that the Federal Reserve would not turn until inflation expectation approached 2%, and rate cuts looked unlikely to occur before 2024.

Iron Ore Key Indicators:

• Platts62 $112.15, -6.05, MTD $119.66. BHP narrowed discount of MACF from 4% to 3% on the May term contract, while narrowed JMBF from 1.5% to 0%. The market participants wasn’t surprised because of the enhanced import margin on the two brands of iron ore. However, traders believed it is hard to sustained, after the import margin narrows in future weeks.

• FMG Q1 iron ore production reached 46.1 million tons, down 8% from last Q4, up 4% on the year. FMG Q1 iron ore delivery at 46.3 million tons, down 6% from last Q4, up 12% on the year. C1 cost $17.73/ton, up 3% from last Q4, up 12% on the year. Production guidance at 187- 192 million tons, unchanged from last prediction.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 21st)

• Futures 98,732,300 tons(Increase 673,300 tons)

• Options 111,718,200 tons(Increase 2,527,000 tons)

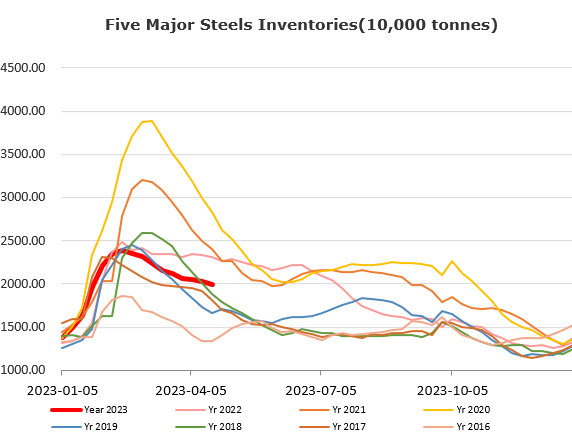

Steel Key Indicators:

• World Steel Association: 63 membership countries total produced 165.1 million tons of crude steels, up 1.7% on the year, created the first positive growth since October 2022.

• The FOB China HRC dropped by 15- 20 yuan/ton last week to $640- 650/ton.

Coal Indicators:

• China physical coke price down 100 yuan/ton for the fourth rounds, total down 400 yuan during the past 4 weeks.