Market Verdict on Iron Ore:

• Neutral to bullish.

Macro:

• The draft of China banks’ mortgage approvals became a sign for the levy of real estate tax. However most of house analysts believed that the tax potentially take many years to land. Moreover, some big southern cities eased house buying restrictions for non-residents.

Iron Ore Key Indicators:

• Platts62 $104.35, -2.45, MTD $117.90. The narrowed discount in mid-grade and low grade lowered the cost efficiencies. In comparison, high grade become cheaper. MB65- P62 spread expected to expand. Seaborne trades became active yesterday after a weekly drop on iron ore price and light market. Corex traded Fe62% PBF + $2.7 premium based on June index. MACF was traded in fixed price at $100.4, with current strong demand on mid-grade with a discount cargoes.

• MySteel estimated that 9 out of 26 mills in China Shanxi would start production cut from April 26th, accounting for 42,500 tons of pig iron production per day. China Hubei province started production curb, expect to delivery less steels to market in May compared with April.

SGX Iron Ore 62% Futures& Options Open Interest (Apr 25th)

• Futures 100,760,800 tons(Increase 2,229,500 tons)

• Options 113,501,400 tons(Increase 1,277,200 tons)

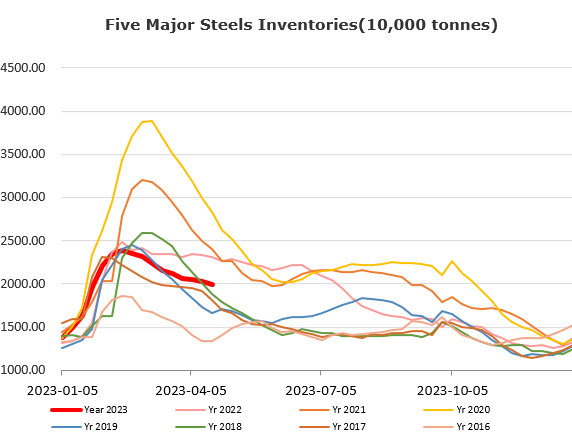

Steel Key Indicators:

• Turkish steel mill Isdemir indicated that the company capactiy has recovered to pre-earthquake level.

Coal Indicators:

• There was a full panamax laycan of PMV offer at $260, came in a seller’s option including Goonyella C, Riverside or Caval Ridge.