Market Verdict on Iron Ore:

• Neutral.

Macro:

• The European Central Bank slowed down its rate hike on Thursday, but hinted at further tightening policies in the future, which the market expects to be the final stage of its fight against inflation. All European Central Bank decision-makers, except for the Management Committee and Austrian Central Bank President Holtzmann, support a 25 basis point interest rate hike to raise deposit rates to 3.25%. ECB President Lagarde said at a press conference that she was not expecting to stop interest hike.

• IMF published “Economic Outlook for Asia and Pacific report”, which mentioned that China and India would drive up economic growth rate by 4.6% in the area, faster than 3.8% in 2022.

Iron Ore Key Indicators:

• Platts62 $104.05, -2.15, MTD $105.55. The physical market recovered active although the fast correction on derivative market. MACF traded in fixed price at $98.3.

• India NDMC iron ore produciton in April reached 3.51 million tons, up 11.42% on the year. April sales reached 3.43 million tons, up 9.93% on the year.

SGX Iron Ore 62% Futures& Options Open Interest (May 4th)

• Futures 81,752,800 tons(Increase 1,603,800 tons)

• Options 97,631,400 tons(Increase 967,500 tons)

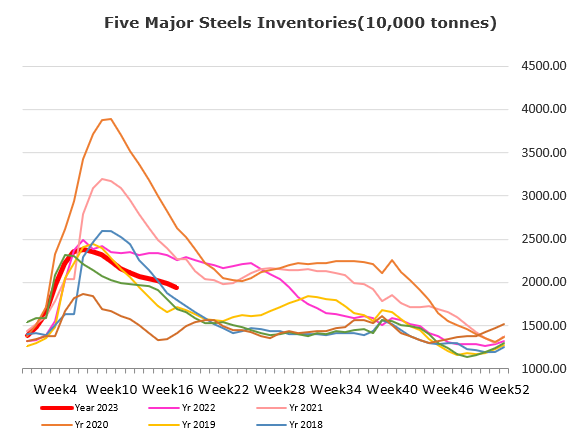

Steel Key Indicators:

• MySteel sample EAFs indicated that average steel cost 3895 yuan/ton, down 18 yuan/ton on the week, average production losss at 80 yuan/ton.

Coal Indicators:

• The FOB Australia market has a split view on the market, while waiting for Chinese buyers returning from Labour Day holiday.