Market Verdict on Iron Ore:

• Neutral.

Macro:

• According to Reuters News, the deadlock in raising the federal government’s $31.4 trillion borrowing limit in the U.S. is exacerbating concerns about the global economy. The latest report from the Congressional Budget Office (CBO) pointed out that a “significant risk” of a historic default may arrive as early as June 1st.

Iron Ore Key Indicators:

• Platts62 $103.05, +0.20, MTD $105.52. Secondary market regained popularities, PBF were traded at IODEX June Index + $1.7. Market sources indicated that the Tangshan domestic concentrates supply were tight.

SGX Iron Ore 62% Futures& Options Open Interest (May 12th)

• Futures 88,565,600 tons(Increase 1,336,300 tons)

• Options 105,279,800 tons(Increase 1,250,000 tons)

Steel Key Indicators:

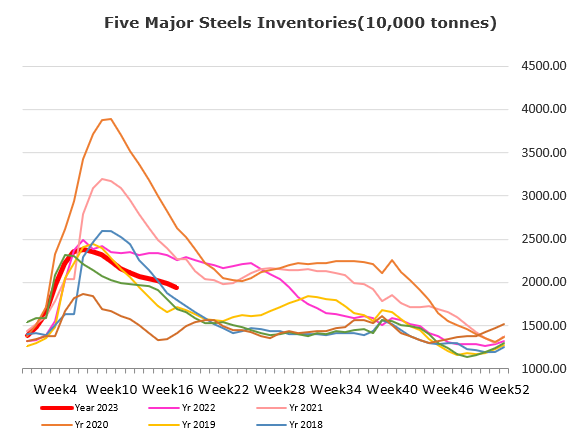

• China CISA statistic indicated that early May crude steel production at 2.25 million tons, up 2.0% from late April. Steel inventories 17.61 million tons, down 2.76% from late April.

Coal Indicators:

• The FOB Australia coking coal market inched down because of the current supply increase in both PLV and PMV market. JFE bought a June laycan PLV Saraji coking coal at $234.5/mt.